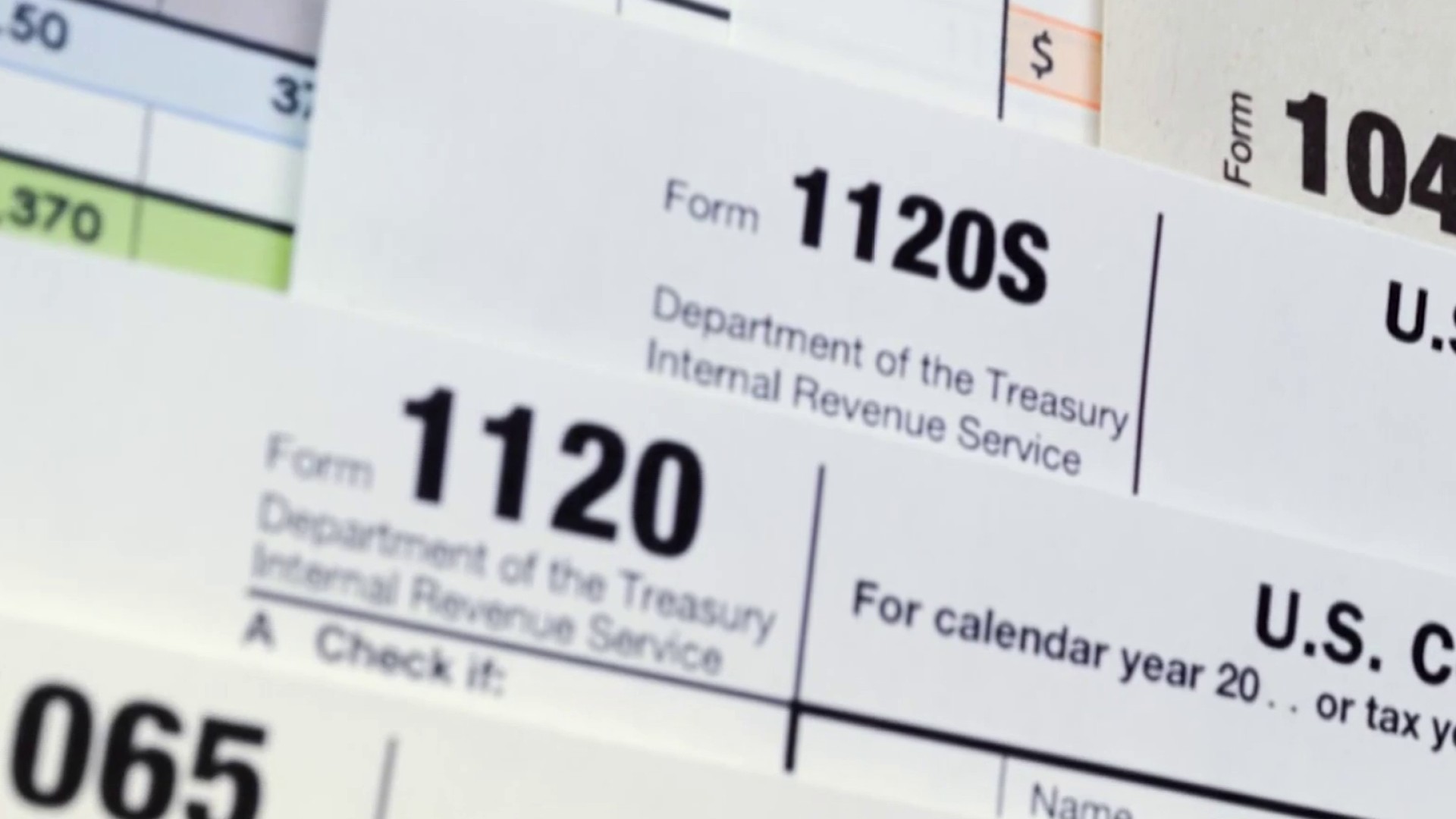

All Elite Boost: AEW Lands $1.275 Million Tax Credits in Ohio

Ohio Gives AEW a Major Boost AEW to Receive $1.275 Million in Tax Credits for Upcoming Events According to f4wonline, Ohio is giving AEW a big help. They will get $1.275 million for some events that will happen in 2024 and 2025. This is a big deal because AEW has been making movies and TV … Read more