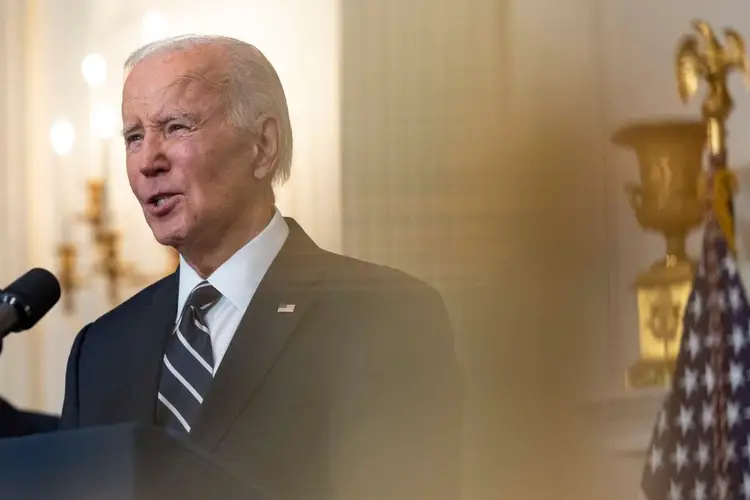

Student Loan Bankruptcy Relief Surges: 588 Cases Filed Under Biden Policy

Biden Policy Spurs 36% Increase in Student Debt Discharges via Bankruptcy

In a significant development for student loan borrowers data released by the Department of Justice indicates a notable increase in successful student debt discharges through bankruptcy following a policy change initiated by the Biden administration nearly two years ago, according to the published article of CNN. Between October 2023 and March 588 individuals filed for bankruptcy seeking relief from student debt marking a 36% rise compared to the previous six-month period. By March a total of 1,220 new cases had been filed under the revised federal guidance with courts granting full or partial discharges in 98% of the cases decided during this period.

Previously, student loan discharge was notoriously difficult under bankruptcy laws which required borrowers to prove “undue hardship.” The new federal guidance implemented in November 2022 streamlined this process making it easier for borrowers to qualify for debt relief. Acting associate attorney general Benjamin C. Mizer praised the impact of this guidance stating it has made bankruptcy a more viable option for individuals burdened by student loans offering them a fresh financial start.

READ ALSO: Illinois Caretaker Sentenced to 60 Years for Murdering Elderly Woman Over TV Volume

Nearly 600 Seek Student Loan Relief Through Bankruptcy Under Biden’s New Rules

Despite the increase in filings some consumer advocates argue that the number of borrowers benefiting from this change remains disproportionately low compared to those eligible. With an estimated quarter-million people with student loans filing for bankruptcy annually there is ongoing advocacy to improve education and awareness among borrowers, attorneys and courts about the updated guidelines. As the Biden administration continues its efforts to address student debt issues ahead of the November election recent policies have already resulted in significant relief for millions despite challenges such as the Supreme Court’s rejection of a broader student debt forgiveness program last year.

READ ALSO: California Residents Eligible for $5.5 Million Wine and Spirits Settlement