Federal Student Loan Interest Rates Surge for 2024-25 Academic Year: Impact on Borrowers and Biden’s Response

Rising Federal Student Loan Interest Rates: Challenges Ahead for College Affordability

Borrowing to pay for college is set to become significantly more expensive for the upcoming 2024-25 academic year with federal student loan interest rates reaching their highest levels in over a decade, according to the published article of CNN. Undergraduate students will face a new interest rate of 6.53% up from 5.5% the previous year, marking the steepest rate since the 2012-13 school year. Graduate students and parents will see their loan rates increase to 8.08% and 9.08% respectively, the highest since before fixed rates were established in 2006. These changes come as the Federal Reserve maintains high national benchmark interest rates to combat inflation. The rising rates present a challenge for President Joe Biden who is aiming to secure support from young voters ahead of the November election. Although the president does not directly set these rates—they are determined by the 10-year Treasury note auction each May—the increases highlight ongoing economic pressures.

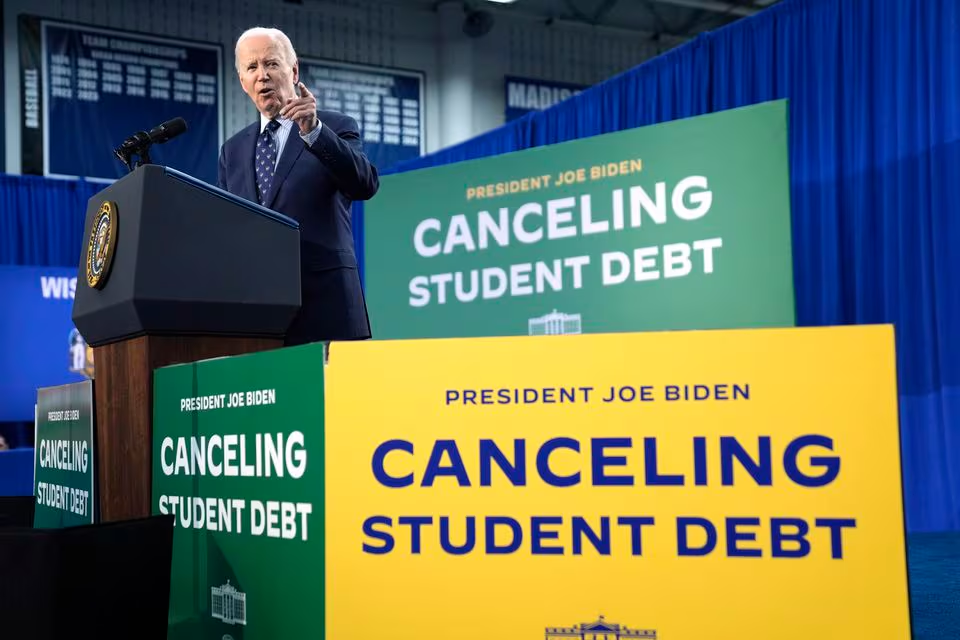

Despite the higher rates, Biden has implemented measures to ease the burden on borrowers including the new income-driven repayment plan known as SAVE (Saving on a Valuable Education). This plan, introduced last year, aims to lower monthly payments and prevent unpaid interest from accruing for those who make full monthly payments potentially reducing lifetime repayment amounts. Biden’s administration has also been working on additional proposals to provide targeted relief to certain groups of borrowers. These new initiatives, which could be finalized by this fall may cancel up to $20,000 for borrowers whose loan balances have increased due to unpaid interest, regardless of their income. This comes after the Supreme Court struck down a broader student loan forgiveness program. While these measures represent significant efforts to address the student debt crisis, the increased interest rates underscore the ongoing challenges faced by current and future students in financing their education.

READ ALSO: Last Chance Alert: Claim Your Unfiled 2020 Tax Refund Before the Deadline Expires!