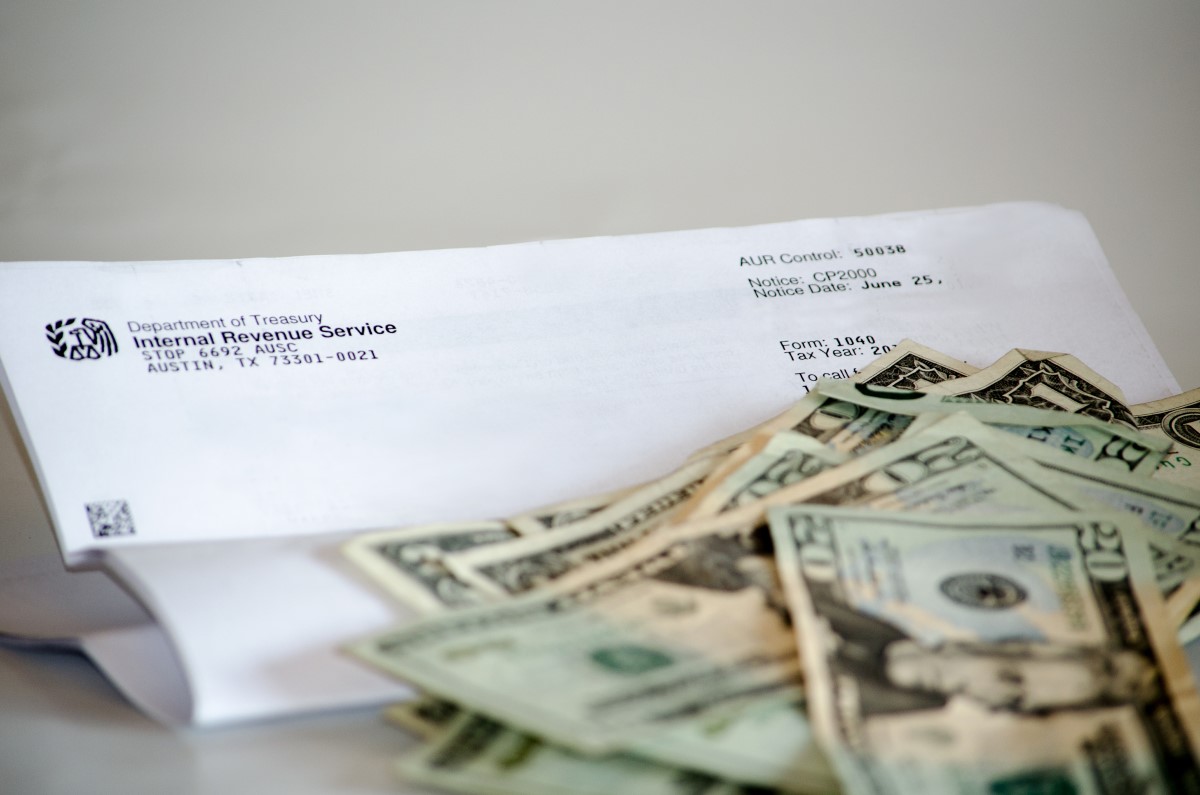

IRS Alerts Texas Residents: $1 Billion in Unclaimed Tax Refunds Set to Expire

The Internal Revenue Service (IRS) has issued a warning to residents of Texas, signaling the potential loss of over $1 billion in unclaimed tax refunds from the year 2020. As the May 17 deadline approaches, approximately 93,400 individuals in Texas alone could miss out on refunds averaging $932 each. The IRS Commissioner, Danny Werfel, emphasized … Read more