Adapting the 50/30/20 Budgeting Strategy: Managing Essential Expenses Amid Economic Challenges

Financial Stability Through the 50/30/20 Budgeting Strategy: Adjusting to Rising Costs

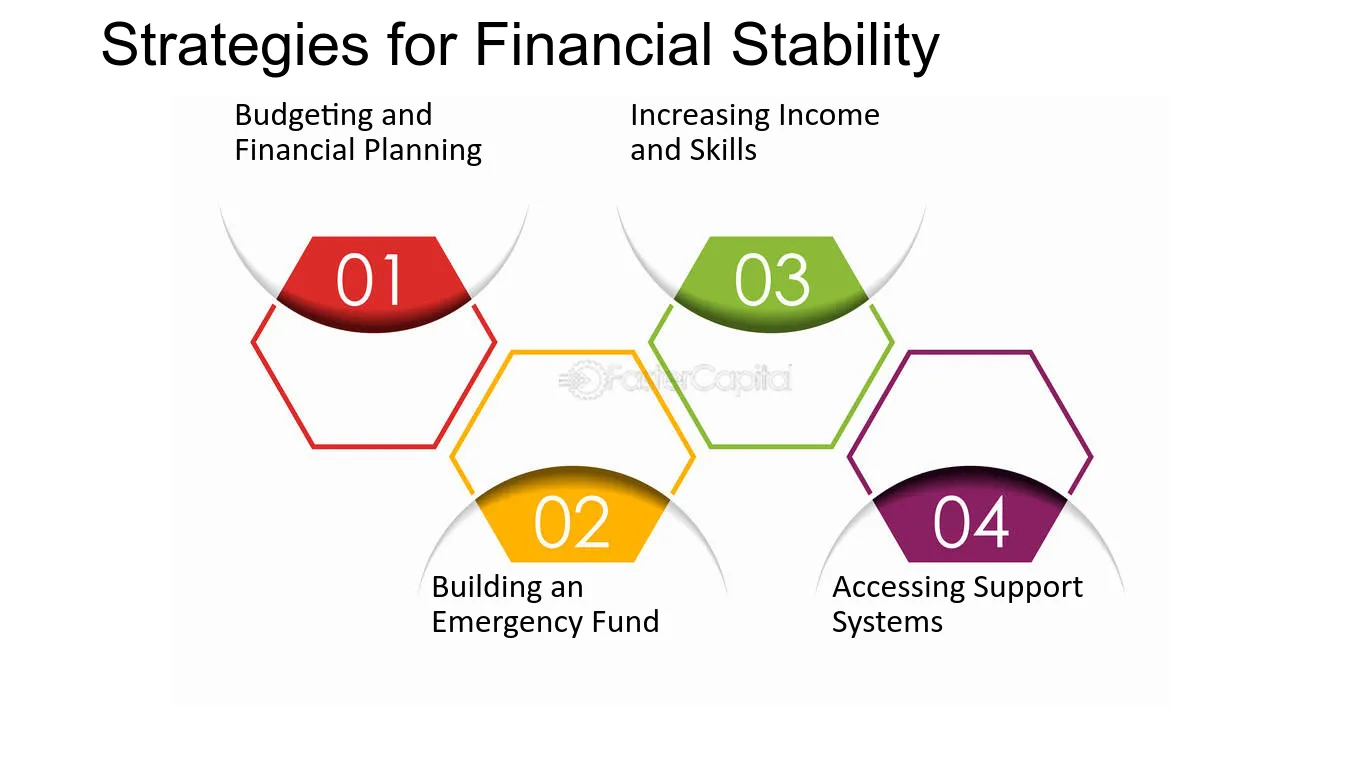

Many households are facing financial challenges and the popular 50/30/20 budgeting strategy is being reconsidered as a useful financial tool, according to the published article of Mirror. This method suggests allocating 50% of your income after taxes to essential expenses like rent and utilities, 30% to discretionary spending and 20% to savings. However, due to the increasing cost of living many households are spending more than half of their income on these essential expenses. To make the budgeting strategy work for more Americans financial experts propose a simple adjustment. If someone is spending 60% or more on essentials they can adjust the ratios. They can allocate 30% of their income to discretionary spending and 10% to savings. This way households can still manage their finances effectively even with higher essential expenses. It allows flexibility to fit individual financial situations while still aiming to save money for the future.

In times of economic strain, such as the current cost of living crisis the 50/30/20 budgeting strategy offers a framework that encourages financial discipline while allowing for adjustments that suit individual circumstances. It emphasizes the importance of balancing immediate needs with long-term financial security empowering households to make informed decisions about their spending and savings priorities. As families navigate fluctuating economic conditions this adaptive approach to budgeting could serve as a practical tool to manage expenses effectively and work towards financial stability.

Empowering Financial Discipline: The Versatility of the 50/30/20 Budgeting Strategy

Furthermore, as households continue to grapple with economic pressures the adaptability of the 50/30/20 budgeting strategy proves invaluable. Beyond simply adjusting percentages individuals can prioritize savings or discretionary spending based on their financial goals. For instance if someone aims to build an emergency fund, they might allocate a larger portion towards savings while reducing discretionary spending temporarily. This strategic approach allows for resilience in the face of financial challenges, ensuring that essential expenses are covered while still making progress towards long-term financial objectives. Moreover, financial advisors emphasize the educational aspect of the 50/30/20 rule which helps individuals understand their spending habits and make informed financial decisions. By tracking expenses and adhering to budgetary guidelines households can gain clarity on where their money goes and identify areas where adjustments can be made.

READ ALSO: California’s Secret to Affordable Education: Claim Your Free College Savings Today!