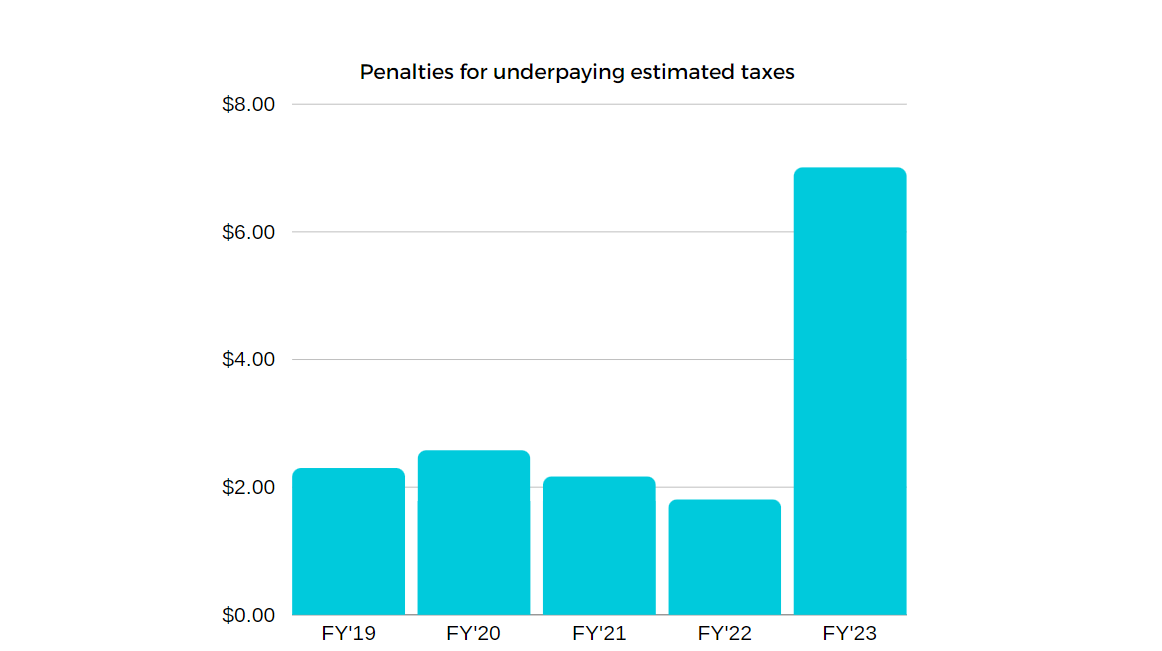

Penalty Payback: IRS Hands Out Record-Breaking $7 Billion in Fines for Late Taxes

Why You Shouldn’t Delay Your Taxes: How Interest Rate Hikes Are Fueling Record-Breaking Penalties

According to WashingtonExaminer, The IRS has given out a record-breaking $7 billion in penalties for not paying taxes on time. Most of these penalties went to freelancers and self-employed people who didn’t pay enough in taxes throughout the year.

These penalties are usually given to people who don’t pay their taxes on time. The penalty rate went up to 8% in the last part of the year, which is almost three times what it was the year before. This is because the Federal Reserve has been raising interest rates, making it more expensive to borrow money.

READ ALSO: Taxation Chaos: Supreme Court Ruling Leaves Billionaire Tax Reform

Don’t Miss the Deadline: Pay Your Taxes on Time to Avoid Record-Breaking Penalties and Fees

If you don’t pay your taxes on time, you might get a penalty. The deadline for the second quarter payment is June 17, and the deadline for the third quarter payment is September 16. The IRS recommends paying your taxes online, which also lets you schedule payments in advance. The IRS wants people to pay their taxes on time to avoid getting penalties.