Undocumented Immigrants Contribute $8.9 Billion Annually in Tax Revenue, Study Finds

Granting Work Permits to Undocumented Immigrants Could Boost Tax Contributions by $40.2 Billion

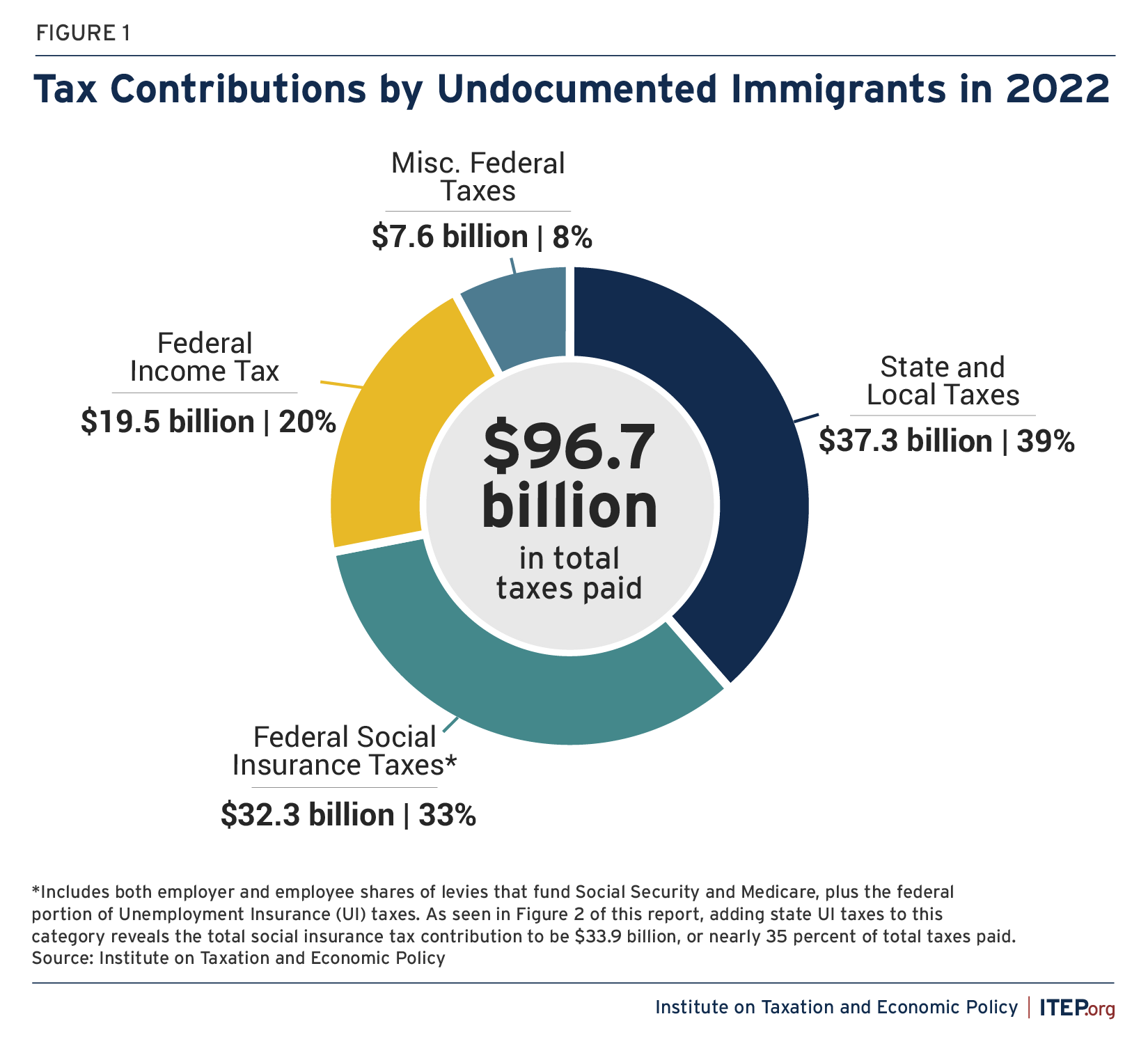

A recent study by the Institute on Taxation and Economic Policy has shed light on the substantial tax contributions made by undocumented immigrants in the United States revealing that in 40 states they pay higher effective tax rates than the top 1% of taxpayers, according to the published article of THE LATIN TIMES. The report highlights the economic benefits of granting work permits to undocumented immigrants as their tax contributions are pivotal for public services. In 2022 the study quantified that for every million undocumented immigrants residing in the U.S. an additional $8.9 billion in tax revenue was generated. Conversely deporting the same number could lead to a significant loss of this revenue.

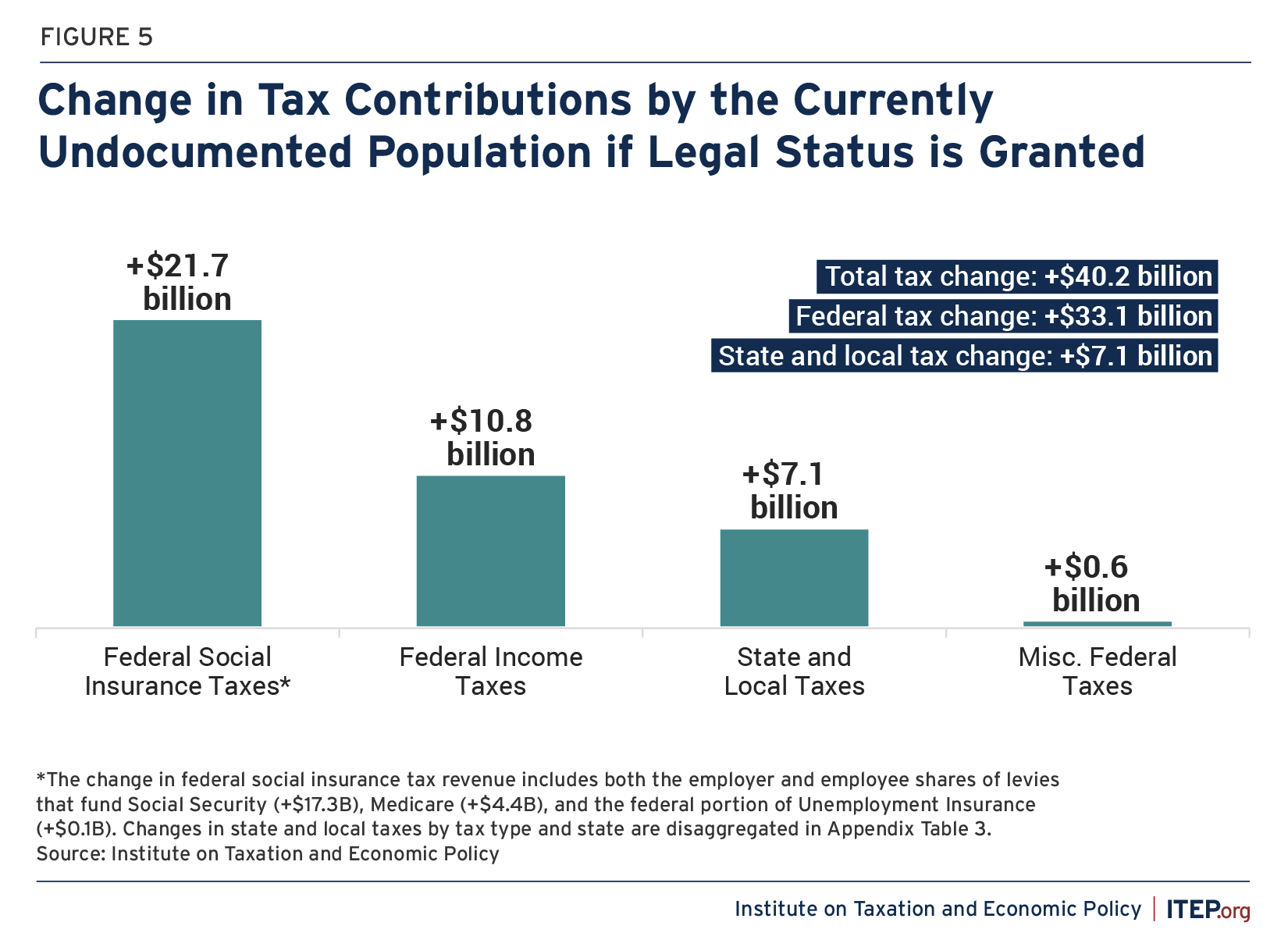

The study further explored the potential impact of granting work authorization to all current undocumented immigrants concluding that their tax contributions would rise significantly. By providing work authorization their annual tax contributions could increase by $40.2 billion reaching a total of $136.9 billion. The majority of this new revenue ($33.1 billion) would benefit the federal government while states and localities would gain $7.1 billion. Notably a significant portion of taxes paid by undocumented immigrants—over one-third—goes to payroll taxes funding Social Security and Medicare programs they cannot access. Additionally, due to ineligibility for substantial tax credits undocumented immigrants often pay more in income taxes compared to U.S. citizens in similar situations.

Undocumented Immigrants Pay Higher Tax Rates Than Top 1% in 40 States, Study Reveals

Furthermore, the findings of this study have significant implications for immigration policy and the broader economic landscape in the United States. Advocates for immigration reform argue that the data underscores the need for policies that provide a path to legal work authorization for undocumented immigrants. Such policies could not only enhance their economic contributions but also promote greater tax compliance and wage increases ultimately benefiting the economy as a whole. Local and state governments are also taking note of the potential financial benefits. With six states already collecting over $1 billion in tax revenue from undocumented immigrants there is a growing recognition of their integral role in funding public services and programs. The increased revenue could support essential services such as education, healthcare and infrastructure providing tangible benefits to all residents regardless of immigration status.