Affordable Homes Under $200,000: Challenges and Opportunities in the U.S. Housing Market

Affordable Homes Decline: Impact on Buyers and Market Trends

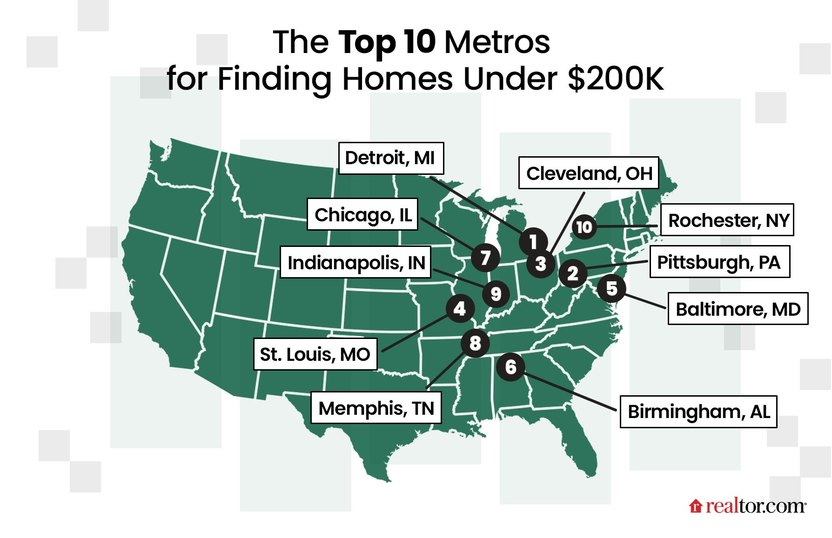

In the ever-challenging landscape of the U.S. housing market the quest for affordable homes under $200,000 has become increasingly daunting. A recent report from USA TODAY highlights a stark decline in the availability of homes within this price range plummeting from half of all sales a decade ago to just 21% today. Meanwhile, national median listing prices have soared nearly 40% since 2019 exacerbating the affordability crisis for many prospective buyers. Despite these daunting trends there are still pockets across the country where affordable housing remains relatively accessible. Cities like Detroit, Michigan lead the charge with a significant inventory of homes priced under $200,000 comprising 64% of all listings in the area.

Following closely is Cleveland, Ohio demonstrating a similar trend in affordable housing availability. In the southern region suburbs of Fort Lauderdale, Florida such as Lauderdale Lakes and Lauderhill stand out for their high concentration of homes priced affordably with 85% and a notable number respectively falling under the $200,000 mark. Hannah Jones a senior economic analyst at Realtor.com notes that these areas are witnessing a surge in affordable options particularly in condominiums providing viable solutions for those looking to downsize or enter the housing market without straining their finances. Despite the overall challenges posed by rising prices and limited inventory these findings offer a glimmer of hope for homebuyers seeking more accessible housing options in today’s competitive market.

Furthermore, the report underscores a regional shift in affordable housing dynamics particularly in the South and upper-Midwest regions of the United States. Analysts point to cities like Albany, Georgia where lower living costs and expanding housing inventory make it an attractive destination for budget-conscious homebuyers. This trend reflects a broader pattern where smaller cities and suburban areas outside major metropolitan centers are becoming focal points for affordable housing solutions. As the housing market continues to grapple with high prices and fluctuating mortgage rates these findings offer valuable insights into where prospective buyers might find the most favorable conditions. The emphasis on affordability in less saturated markets suggests a potential rebalancing of housing dynamics offering hope for those navigating the challenges of purchasing a home amidst economic uncertainties.