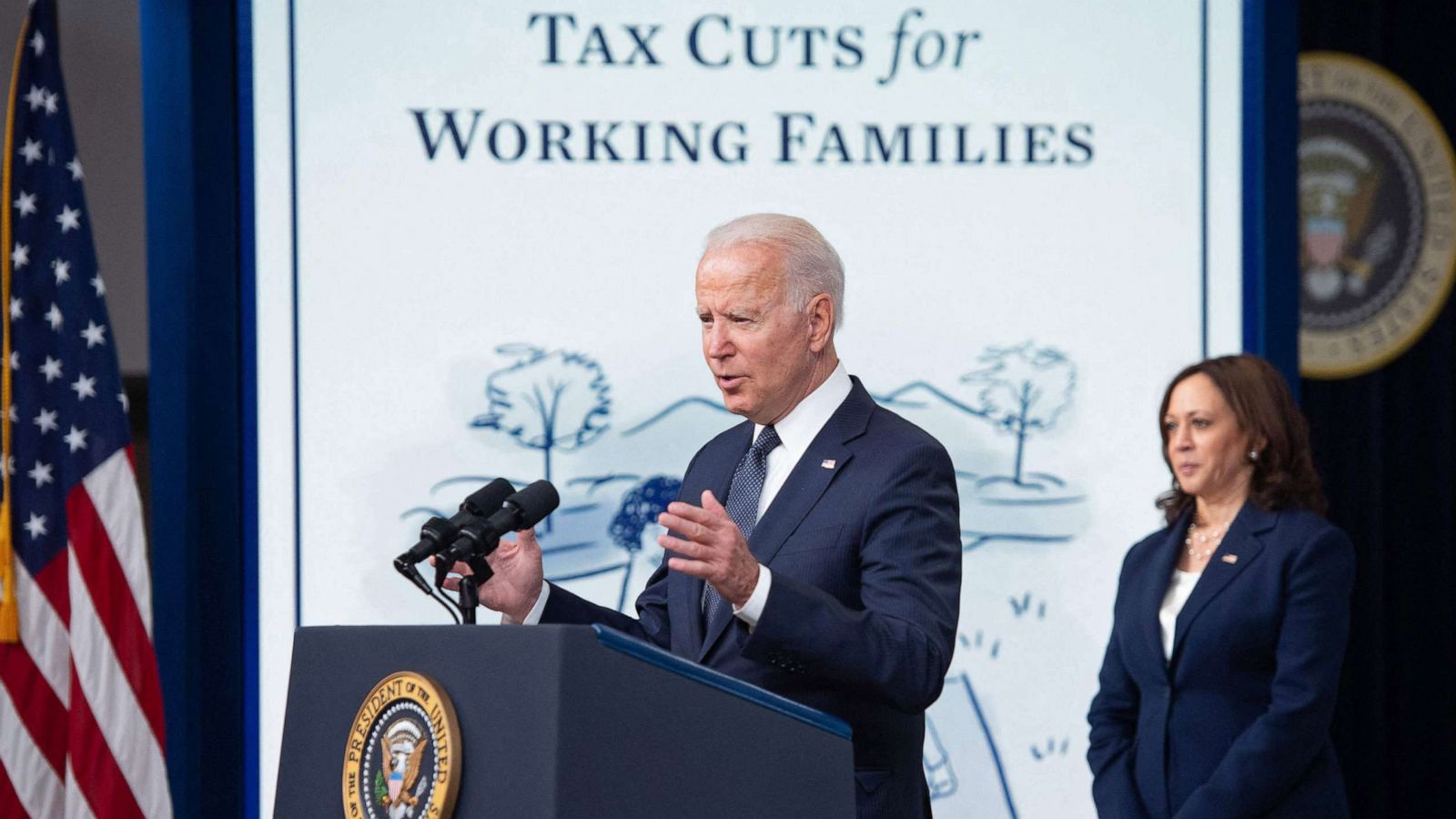

Biden’s Tax Policy Proposal: Impact on Middle-Class Americans and Potential Tax Credit Reductions

Analyzing Biden’s Tax Plan: How Middle-Class Families Could Be Affected by Changes to Tax Credit

According to Washington Examiner, President Biden wants to get rid of the Tax Cuts and Jobs Act (TCJA) saying it’s a big deal for middle-class taxes. The TCJA gave tax cuts to many Americans including those in the middle class. But it also made rich folks pay a bigger share of the taxes. The TCJA did some good things like doubling the child tax credit and standard deduction and lowering tax rates for everyone. If we let it expire it means cutting the standard deduction and child tax credit in half and raising taxes for almost everyone. But rich Americans usually don’t use these deductions so it’s mostly the non-rich who would get hit.

For example, a family making $90,000 a year could see their taxes go up a lot under Biden’s plan. Their tax rate might go from 12% to 15% and their tax credits could go from $6,000 to $3,000. That means they might have to pay around $2,875 more in taxes every year. But there are other options Biden could consider, like making a new tax cut for the middle class or keeping some parts of the TCJA that he likes.

READ ALSO: Fair Pay Revolution: Biden Administration Overhauls Overtime Rules for Salaried Workers

Analyzing the Impact of Biden’s Tax Plan on Everyday Americans: Balancing Tax Credit Reductions and Middle-Class Concerns

Furthermore, the debate over Biden’s plan raises important questions about how taxes affect everyday Americans. Supporters of letting the TCJA expire argue that it’s fairer to make wealthier individuals pay more taxes, while opponents worry about the impact on middle-class families. Finding the right balance between helping the middle class and ensuring the government has enough money to operate will be crucial as lawmakers decide the future of tax policy in the United States.

READ ALSO: Apple and Healthcare Company Settlements: Check yours now!