Divergent Views in Tennessee Assembly Over Corporate Tax Refund

Contrasting House and Senate Plans for Franchise Tax Refund

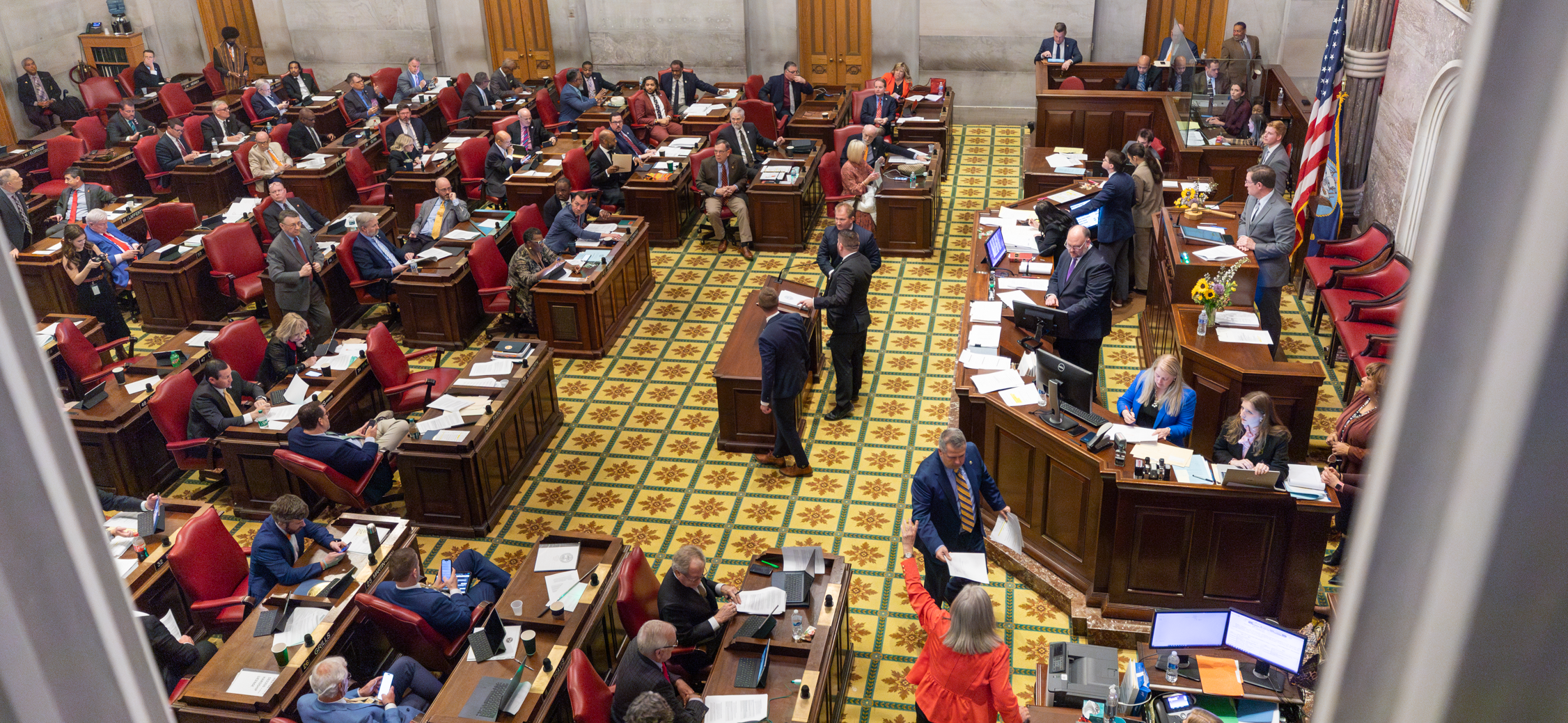

According to the Tennessean, the Tennessee General Assembly is having a big argument about a plan to give a lot of money back to businesses through a franchise tax refund. The House and Senate each have their versions of the plan and Governor Bill Lee supports it. The House’s version lets businesses ask for a tax refund for one year and says the names of the businesses getting tax refunds must be made public. This would cost about $800 million in a year. But the Senate’s plan extends the tax refund time to three years and would cost $1.9 billion including new tax breaks.

READ ALSO: Maximizing Your Retirement Income: Timing Your Social Security Benefits Wisely – Check It Out!

Disagreement Over Corporate Tax Refund Reveals Divisions in Tennessee Assembly

Furthermore, House Republicans believe their plan is beneficial while Senate Republicans fear potential lawsuits. Some House Democrats argue for alternative forms of relief for residents. The assembly struggles to reach a consensus on tax refund duration and transparency necessitating further negotiation in a conference committee to find a compromise.