Tax Assistance from the Minnesota Department of Revenue

Tips for Easy Tax Filing

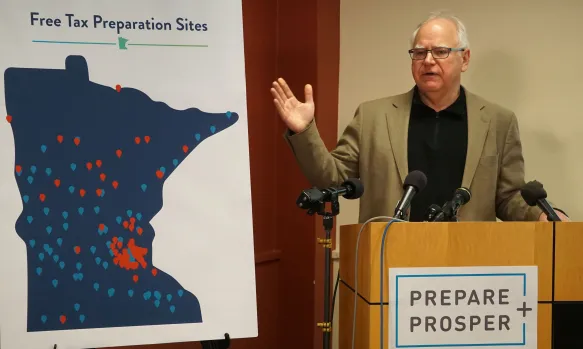

According to the Department of Revenue, as April 15 nears, the Minnesota Department of Revenue is helping people across the state with their taxes. More than 1.4 million Minnesotans have already filed, and over 970,000 refunds have been sent out. The Minnesota Department of Revenue expects many more filings before the deadline. They suggest that folks use electronic filing and direct deposit for refunds to make things easier. If your income is $79,000 or less, you might even qualify for free e-filing.

READ ALSO: Massachusetts Allocates Millions for Shelter and Housing Amidst Overwhelming Demand