Missouri House Considers Tax Proposal Amidst Revenue Concerns

Debate Ensues Over Missouri Tax Proposal Impact on Government Revenue

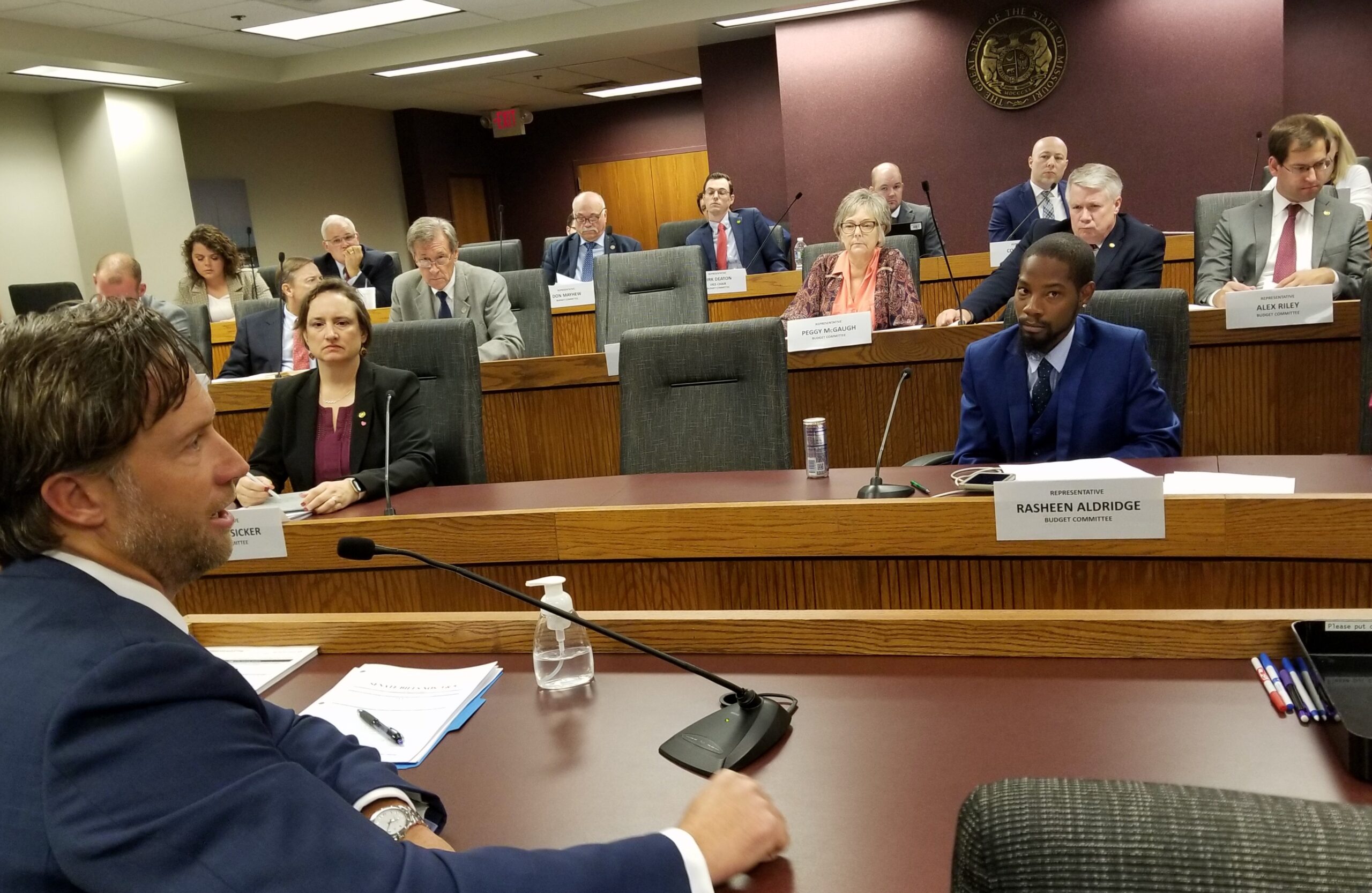

A group in the government is deciding on a new tax plan. The plan, called House Bill 2919 suggests everyone pays a 4% tax on money earned above $1,000 by 2025, according to the published article of The Center Square. Some people think this will bring in more money without cutting services but others worry it might lead to less money for the government according to Brian Colby from the Missouri Budget Project.

Tax Proposal: Missouri Lawmakers Consider Reshaping Tax System with Joint Resolutions 187 and 188

There are also two other ideas called House Joint Resolution 187 and House Joint Resolution 188. They want to make a special fund for taxes. This fund would help lower personal income and property taxes gradually until they reach zero. Then, the money would be used to help if the government doesn’t have enough money in the future. These ideas could change how taxes work in Missouri.