Supporting Older Residents with Senior Property Taxes

Jackson County’s New Initiative to Ease Financial Burdens

According to Lee’s Summit Tribune, Jackson County has introduced a new program called the Senior Property Tax Credit Program. This Senior Property Tax Credit Program helps older residents who own homes with their property tax payments. The Senior Property Tax Credit Program’s idea is to make it easier for them to afford to live in their homes without worrying too much about taxes. It’s a way for the county to support its older residents and improve their lives.

READ ALSO: 120 Communications in 16 Months: Ethics Concerns Surround Agriculture Official’s Ties to Soros-Funded Think Tank!

Qualification and Application Process

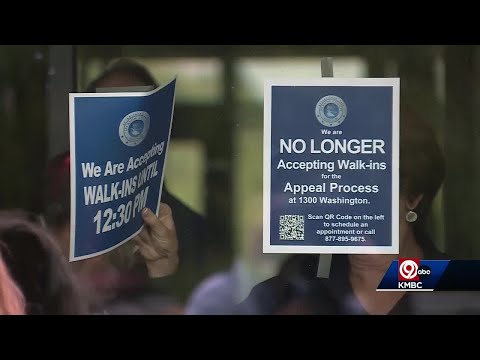

To qualify for this Senior Property Tax Credit Program, residents must meet certain requirements. They should be getting Social Security retirement benefits and owning property in Jackson County. The value of their property must be less than $550,000. If they meet these conditions they can apply for the Senior Property Tax Credit Program and freeze their property tax bill. This means they won’t have to pay more taxes in the future unless something changes. Applications for the Senior Property Tax Credit Program are available online and at specific locations in Jackson County. Residents have until December 31 each year to apply. If they’re approved they need to renew their application every year by August 31 to stay in the Senior Property Tax Credit Program. This initiative shows that Jackson County cares about its older residents and wants to help them stay in their homes comfortably.

READ ALSO: $100 Million Investment Expected to Boost Downtown Shreveport Revitalization!