Student Loan Repayment Uncertainty: Biden’s SAVE Plan Faces Judicial Challenges

Legal Battles Over Student Loan Reform: Biden’s SAVE Plan and Its Impact

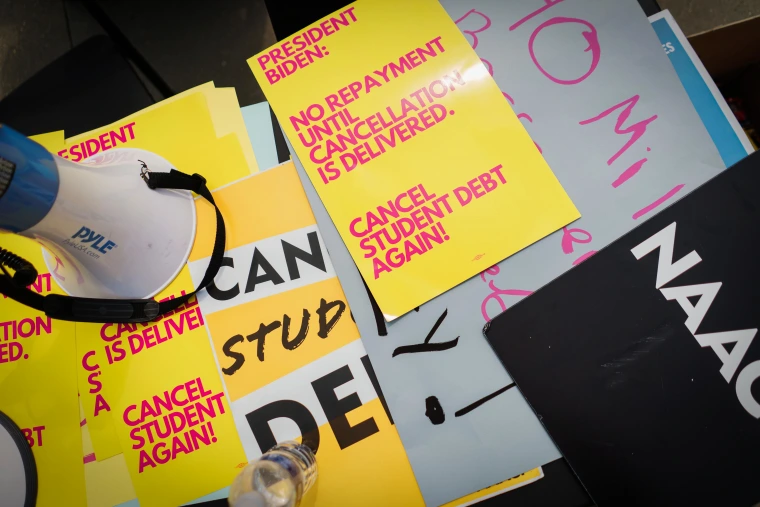

Amid legal battles and administrative changes millions of student loan borrowers across the United States face uncertainty as President Biden’s student loan repayment plan known as SAVE (Saving on a Valuable Education) encounters judicial challenges, according to the published article of CNN. A federal appeals court recently allowed the Department of Education to proceed with implementing reductions in monthly loan payments under SAVE despite injunctions issued by courts in Missouri and Kansas that temporarily halted parts of the plan. These legal disputes underscore broader disagreements over the administration’s authority to enact such sweeping changes to student loan repayment terms. SAVE launched in response to the Supreme Court’s rejection of a previous student loan forgiveness initiative aims to significantly reduce monthly payments and streamline the path to debt forgiveness for enrolled borrowers.

For nearly 8 million participants including those expecting lower payments starting in July the legal uncertainty has added complexity and confusion. While the appeals court ruling allows the reduction in payments to proceed for now ongoing litigation could potentially alter the course of these reforms affecting borrowers’ financial planning and obligations. The Biden administration faces criticism and support alike for its efforts to overhaul student loan repayment with opponents arguing the legality and efficacy of the SAVE plan. As borrowers navigate these legal and administrative hurdles including the reinstatement of online application access for income-driven repayment plans the Department of Education advises regular updates and vigilance through official channels. The outcome of these legal battles will likely have profound implications for the future of student loan management and debt relief initiatives nationwide.

READ ALSO: Illinois Laws 2024: Minimum Wage Increase, Gas Tax Hike, and More Take Effect July 1

SAVE Plan Legal Disputes: Student Loan Borrowers Navigate Uncertainty

Furthermore, the legal battles surrounding the SAVE plan have highlighted deep divisions among states and stakeholders regarding federal oversight of student loan policies. Republican-led states including Missouri and Kansas argue that the Biden administration exceeded its authority in implementing SAVE prompting judicial intervention to halt certain aspects of the plan. This legal showdown underscores broader debates over states’ rights versus federal mandates in education and financial regulation. Meanwhile, the implementation of SAVE continues to impact millions of borrowers many of whom face ongoing challenges with student loan repayment amid the COVID-19 pandemic recovery. The plan’s promise of faster debt forgiveness and reduced monthly payments offers potential relief to borrowers burdened by student loan debt yet its future remains uncertain pending court decisions.

READ ALSO: July Class-Action Lawsuits: Claim Your Compensation Before Deadlines