Rising US Credit Card Debt Spurs Search for Relief Strategies

Debt Settlement, Consolidation, and Bankruptcy: Options Amid US Credit Card Debt Surge

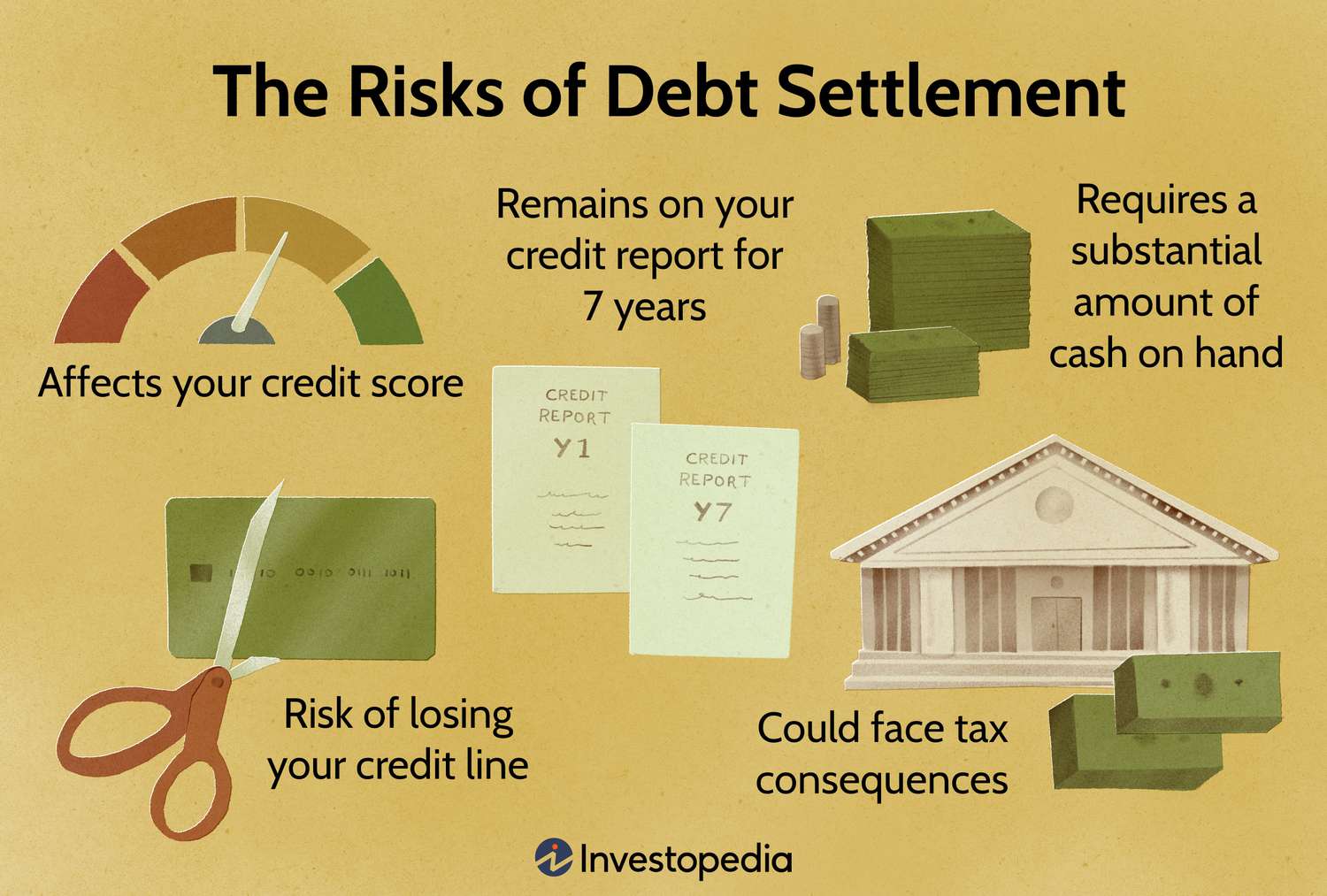

Amidst rising US credit card debt totaling $1.13 trillion as of Q4 2023 many Americans are seeking relief strategies, according to the published article of MARKET REALIST. Options like debt settlement where borrowers negotiate reduced debts due to financial hardships and debt consolidation combining debts into a single lower-interest loan are popular. Some turn to credit counseling agencies or consider bankruptcy for financial stability amidst these challenges.

Another sought-after method debt consolidation consolidates multiple debts into a single loan with a lower interest rate streamlining repayment into a single monthly installment. However, qualifying for debt consolidation typically requires a credit score in the mid-600s along with other financial credentials such as home equity and proof of repayment capability. For those facing severe financial distress debt management plans facilitated by nonprofit credit counseling agencies offer structured pathways to renegotiate debt terms albeit with potential constraints on opening new credit accounts during the program’s duration.

Managing US Credit Card Debt: Strategies for Relief and Financial Stability

Lastly, bankruptcy remains a final recourse for individuals overwhelmed by credit card debt. Chapter 7 bankruptcy wipes out unsecured debts like credit cards entirely while Chapter 13 allows for a structured repayment plan over several years. Although bankruptcy can provide relief it comes with long-term consequences such as a significant impact on credit scores for up to a decade. Despite these challenges many see bankruptcy as a means to eventually restore financial health after a period of recovery. As Americans navigate these complex decisions the search for effective debt relief strategies underscores the importance of informed financial planning and seeking professional guidance to determine the best course of action tailored to individual circumstances. With each method offering distinct benefits and considerations the goal remains to achieve long-term financial stability and alleviate the burden of overwhelming credit card debt.

READ ALSO: Why Banks Will Close on the 4th of July?