The number of China hedge funds has decreased for the first time in years, with only a handful of new funds being launched and several funds being liquidated. This shift is attributed to a combination of factors, including Beijing’s crackdown on private companies, growing geopolitical tensions with the US, weak returns, and concerns about political risks.

China Hedge Funds Struggles

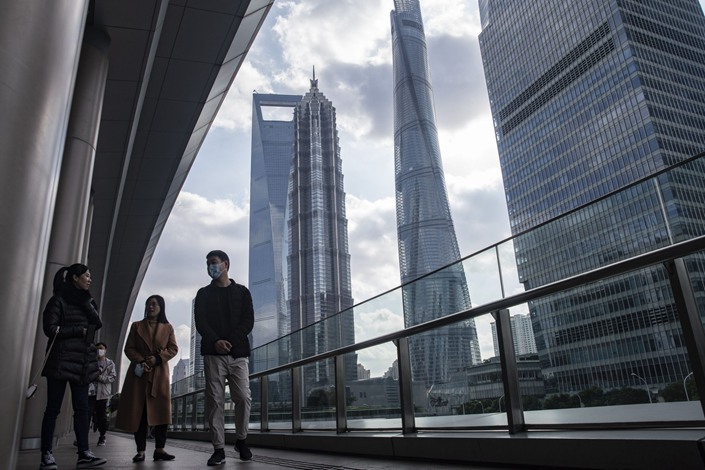

Bloomberg – Foreign investors’ enthusiasm for China is waning, causing a decline in China-focused hedge funds for the first time in years. Data from Preqin reveals that only five new funds were launched targeting the Chinese market in the first half of this year, while 18 China hedge funds were liquidated. This shift marks a stark change in the landscape for offshore China hedge funds, which previously constituted a significant portion of new funds in Asia. Geopolitical tensions with the US and Beijing’s crackdowns on private companies have led to weak returns and diminished global investor appetite for Chinese assets.

China-focused hedge funds, particularly those centered around stock picking, are grappling with consecutive years of losses. In 2022, over two-thirds of such China hedge funds recorded losses, and in the first half of 2023, 62% failed to generate profits, according to Eurekahedge and Preqin data. The MSCI China Index’s 43% drop since the end of 2020, in contrast to the US S&P 500 Index’s 19% gain, reflects the challenging environment for China-focused investments. Investors are increasingly concerned about the political risks associated with investing in China and are becoming less optimistic about the country’s long-term economic prospects.

As a result of these challenges, hedge fund managers are contending with difficult decisions. Some China hedge funds have been liquidated, while others are grappling with significant losses. With geopolitical uncertainties persisting and the economic outlook uncertain, foreign investors are taking a cautious approach to their China investments, leading to an overall contraction in the once-booming market for China-focused hedge funds.

READ ALSO: China’s Bioscience Ambitions: Balancing Genetic Data Control and Global Collaboration

China’s Economic Challenges Impact Hedge Funds

According to Financial Review, China’s economic recovery is stalling despite policy support, while geopolitical tensions with the US persist. Though outwardly optimistic, managers privately express concerns over the decline of offshore China hedge funds. The Legends China Fund and Blue Creek China Fund, both prominent China hedge funds, have faced substantial losses. The vulnerability of these China hedge funds arises from their focus on equity long-short strategies, which have struggled given the market’s poor performance.

As investors grow cautious due to political risks and economic uncertainties, China hedge fund managers are exploring new strategies, including shifting focus to domestic audiences and diversifying their investor base.