Pros and Cons of Extended Repayment Plan for Student Loans: A Detailed Overview

Is the Extended Repayment Plan Right for You? Understanding the Benefits and Drawbacks

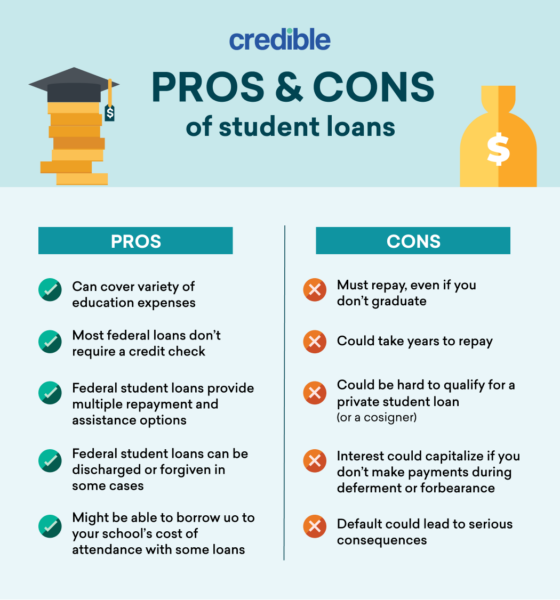

According to Marca, the extended repayment plan for student loans has good and bad points for Americans dealing with big educational debt. It helps by making monthly payments lower and giving more time, up to 20 years more, to pay back the loan. But it’s only for Americans who owe more than $30,000 in federal student loans. This can help Americans struggling with money to handle their monthly bills better and avoid missing payments.

But there are also bad things about this plan. Americans who owe less than $30,000 can’t use it, so it’s not an option for everyone. And even though smaller monthly payments might seem nice, they can make you pay more interest over the whole time you’re paying back the loan. Unlike other plans based on income, this one doesn’t look at how much money you make, which could make it tough for some Americans to keep up with payments.

READ ALSO: Warning: Verify Your Tax Code to Avoid Paying More to HMRC

Navigating Student Loan Repayment: Considerations for Choosing the Right Plan

So, Americans need to think carefully about whether this plan is right for them. Some might decide to focus on paying off one loan at a time instead, or they might look into other repayment plans that fit their situation better. With so many Americans dealing with student loan debt, everyone must make smart choices about how they manage their money and pay back what they owe.

READ ALSO: New York Pension Funds Under Scrutiny for Alleged Ties to Predatory Legal Lenders