Colorado’s TABOR Refund Overhaul: Governor Polis Leads Transformation with Novel Methods

TABOR Refund Changes in Colorado: Governor Polis Drives Significant Fiscal Reforms

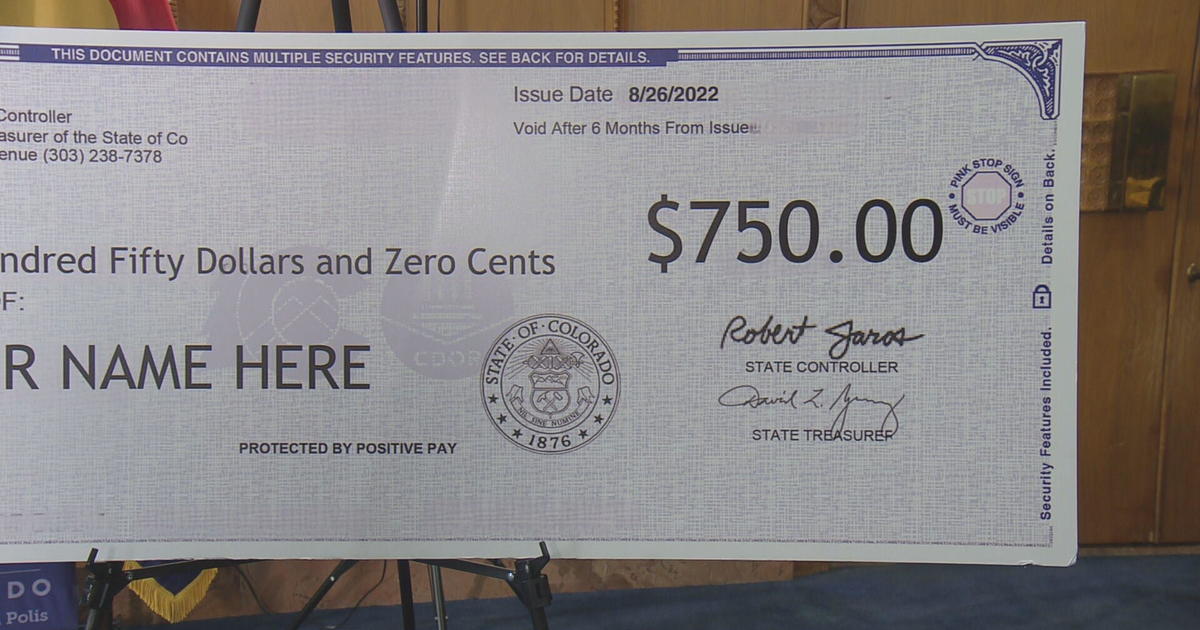

Colorado’s approach to issuing TABOR refunds is undergoing a significant transformation promising substantial changes in the future amounts received by taxpayers, according to the published article of AXIOS. Governor Jared Polis, alongside bipartisan lawmakers is spearheading a bill aimed at refunding excess state revenue through two novel methods. These methods hinge on the total rebate amount projected over the next decade. The first method involves a temporary reduction in income tax while the second entails a decrease in the state sales tax rate. Democrats argue that these methods offer a more timely approach compared to traditional rebate checks issued during tax filing. This shift marks a pivotal departure from the current practice of issuing sales tax refunds based on income at tax filing which would only come into play during years with substantial excess revenue. The overhaul represents a significant win for Governor Polis, aligning with his longstanding pledge to lower the state’s income tax.

The Taxpayer’s Bill of Rights (TABOR) a cherished constitutional amendment among conservatives, sets a cap on state tax collections but allows for adjustments in refund mechanisms. However, the future of TABOR refunds faces challenges from other Democratic-driven tax credit initiatives potentially reducing the size and likelihood of future refunds. The proposed income tax cut within the TABOR bill has drawn attention for primarily benefiting the wealthy conflicting with broader Democratic efforts. Nevertheless, Governor Polis had earlier issued a firm directive to lawmakers insisting on including a tax reduction as part of any TABOR adjustments. However, the implementation of these new refund mechanisms remains contingent upon approval from the IRS which is evaluating whether the rebates could be considered taxable income. As discussions continue, Senator Kyle Mullica emphasized the importance of seizing opportunities to cut taxes reflecting the sentiments of Colorado residents eager for fiscal relief.

Future of TABOR Refunds in Colorado: Governor Polis Proposes Substantial Changes

Furthermore, the proposed changes to TABOR refunds underscore the complexities inherent in balancing fiscal responsibility with social welfare priorities. While the shift towards income tax reduction may align with Governor Polis’s agenda it also raises questions about equity and the distribution of benefits across different income brackets. The concurrent push for child tax credits and an expansion of the earned income tax credit speaks to the broader tension between providing relief for lower-income earners and navigating the constraints of TABOR regulations. As Colorado lawmakers navigate these intricacies the ultimate impact of these reforms on the state’s fiscal landscape and its residents remains to be seen.

READ ALSO: $1 Billion in Unclaimed Tax Refunds Await for 2020 Tax Year: IRS Urges Action