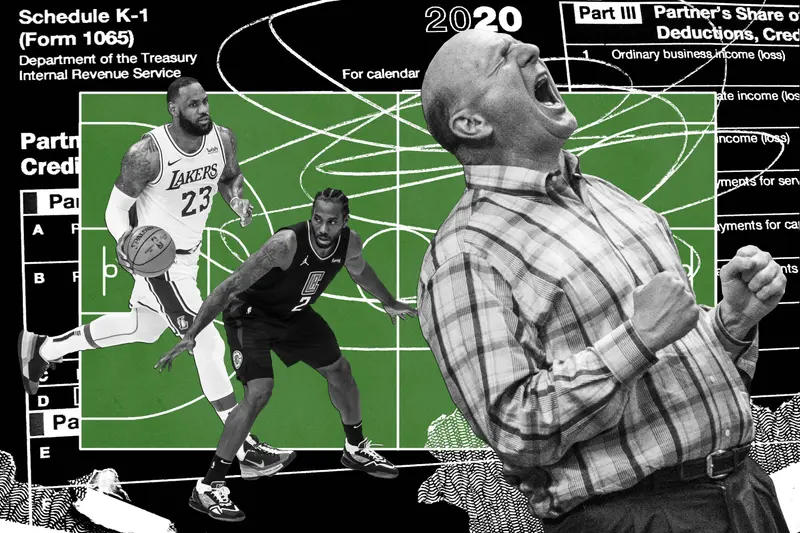

IRS Probes Wealthy Sports Team Owners for Potential Tax Violations

Calls for Fair Taxation Grow as IRS Intensifies Oversight on Sports Business Taxes

According to ProPublica, the IRS is investigating how wealthy sports team owners handle their taxes suspecting some may be violating tax laws. This initiative announced this year aims to ensure that sports businesses accurately report losses on their taxes. ProPublica’s investigations revealed that billionaire team owners often underreport their income to pay less in taxes.

This scrutiny has led to calls for increased IRS oversight to ensure fair taxation. Consequently the IRS is focusing more on verifying whether wealthy sports team owners comply with tax regulations.

Wealthy Sports Team Owners Exploit Tax Loopholes, Pay Lower Taxes Than Players

Certain wealthy sports team owners benefit from significant tax breaks by claiming their team assets depreciate over time. However since sports teams typically generate substantial revenue this practice has raised concerns. Owners like Steve Ballmer of the Los Angeles Clippers have allegedly saved substantial amounts on taxes through this method. ProPublica’s findings indicated that these owners pay lower taxes than even their players.

READ ALSO: California Governor Gavin Newsom Navigates Budget Crisis Amid Revenue Shortfall