New Law Proposed to Aid Pennsylvania Families with Childcare Tax Costs

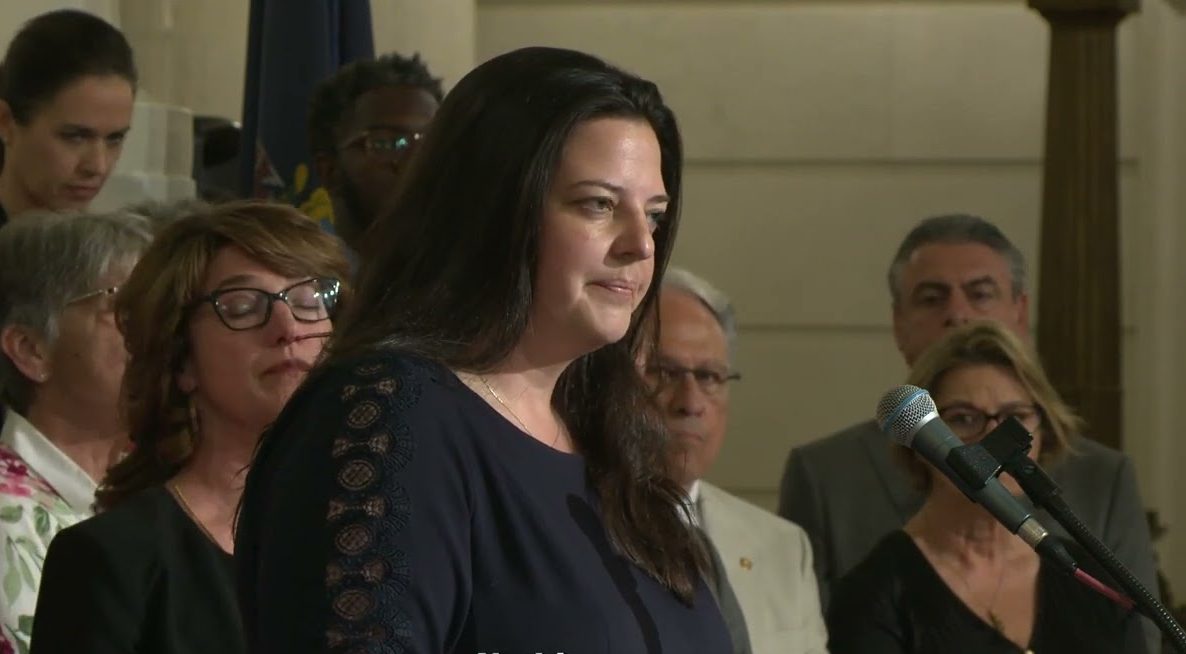

Representative Liz Hanbridge Advocates for Crucial Support for Working Families

According to the Washington Examiner, Pennsylvania families facing tough times finding affordable childcare might soon get some help from a new law being discussed. The House Finance Committee met to talk about a bill suggesting that employers who help with childcare tax costs for their workers could get a tax break. Representative Liz Hanbridge who supports the childcare tax bill says it’s crucial, especially when childcare tax costs force women to give up on their careers. The bill aims to fix this by encouraging employers to pitch in for childcare tax expenses.

READ ALSO: Controversial Arizona Bills Propose Strict Work Requirements for Food Assistance – Sparking Debate Among Lawmakers and Advocates!

Business Leader Backs Bill to Alleviate Parental Financial Strain

Laura Manion from the Chester County Chamber of Business and Industry supports the childcare tax bill saying it could help businesses find good workers and ease parents’ money problems. But she notes that many businesses aren’t sure how to assist with childcare. The childcare tax bill suggests letting businesses deduct what they spend on childcare for their workers. However, Diane Barber from the PA Child Care Association worries the childcare tax bill might not fix all the problems like long waitlists and not enough spots in childcare centers. She says more investment is needed to improve child care for Pennsylvania families. As lawmakers discuss the childcare tax bill the focus remains on ensuring families can find affordable and quality child care.