The legal challenges faced by the administration’s student loan forgiveness initiatives, specifically on private for-profit colleges and trade schools in Texas contesting the new rules under the Biden/Harris administration.

Private Colleges Challenge Student Loan Rules

According to the article of Milwaukee Texas, Senator Lena C. Taylor stated that Texas has become the stage for a legal showdown as private for-profit colleges and trade schools take on the new administration rules that aim to wipe out loans for students who were misled by colleges or left in the lurch due to sudden closures. There would be a trial that is scheduled for November, and while the administration is staying committed to addressing the student loan challenge and making student loan challenge relief a reality, the path ahead is anything but clear.

As we gear up for the end of the current break from student loan payments at the close of this month, a fresh set of student loan challenges is on the horizon. Starting September 1, 2023, interest will rear its head again on federal student loans, making payments due for most of us in October. So, how do we navigate this tricky student loan challenge terrain? The Federal Student Aid office is stepping in to offer a helping hand, providing guidance on how to transition back into repayment mode. Their advice? Make sure your contact info is up-to-date with both the federal office and your loan servicer to get the scoop on when that first payment will be knocking at your door.

Furthermore, as indicated in the article, the Department of Education is rolling out an “on ramp” student loan challenge program, giving us some flexibility until September 30, 2024, as we make our way back to the repayment lane. If you end up missing a payment or can’t swing a full one, don’t sweat it—this time around, you won’t have to worry about the credit bureau getting a not-so-great update about you. Plus, any interest you haven’t paid won’t jump on your back once this grace period ends. And if you’ve been caught up in the student loan challenge default whirlwind, there’s a “Fresh Start” student loan challenge program offering a hand to pull you out.

READ ALSO: August Social Security Payments Deliver Up to $4,555 Directly to Millions Within Five Days

Resuming Student Loan Payments; Solutions Ahead

Based on the article of Investopedia, the recent decision from the Supreme Court to restart student loan payments arrives during a challenging financial period. The aftermath of the pandemic, coupled with inflation and increasing interest rates, has created additional strain. Data from the CFPB reveals that as of September 2022, 7.1% of student loan borrowers found themselves struggling to keep up with other financial obligations—reflecting a notable rise from the pre-pandemic rate of 6.2%.

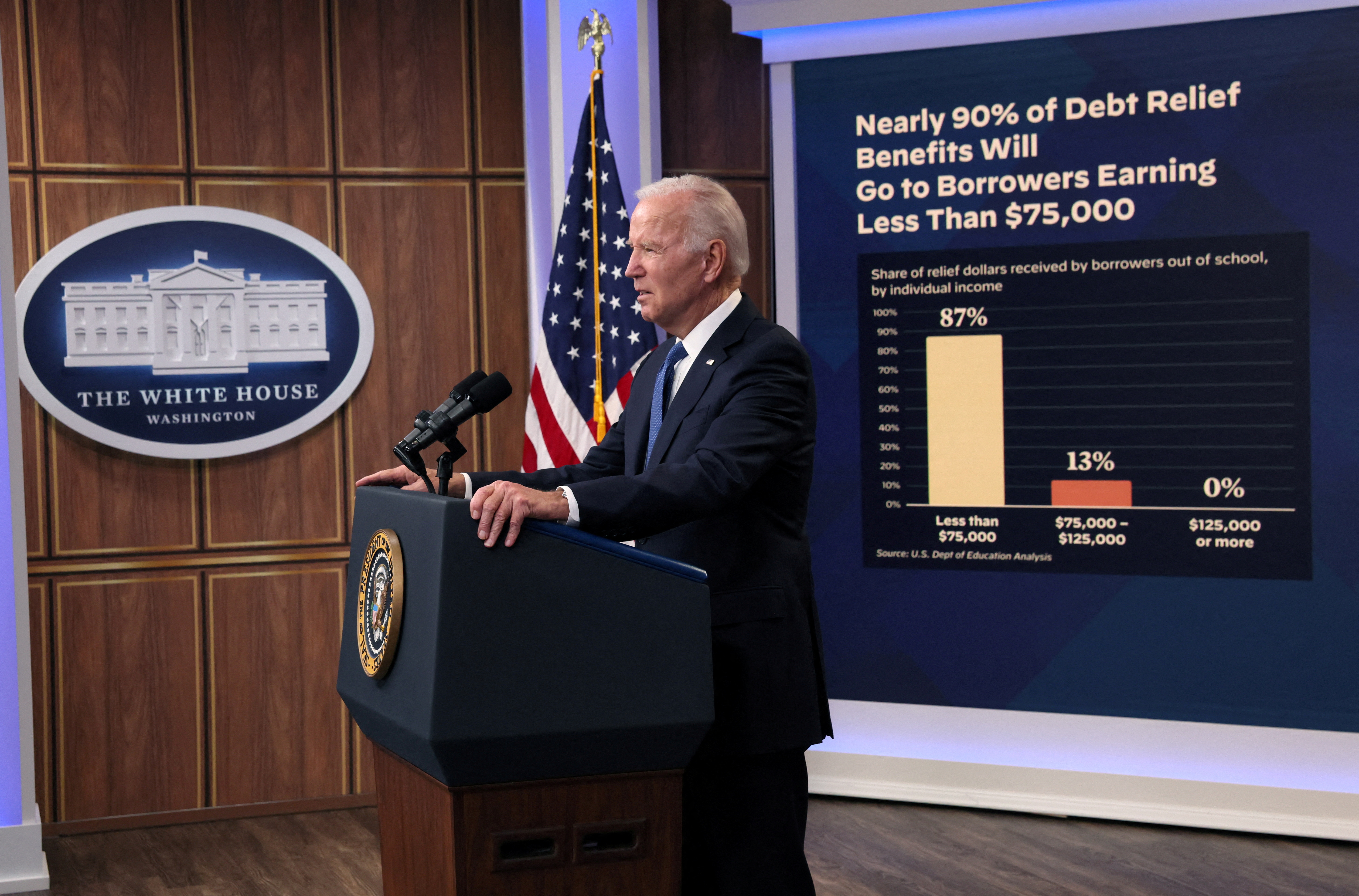

In response to these student loan challenges, the Biden-Harris administration rolled out the Saving on a Valuable Education (SAVE) plan, offering various relief measures for student debt. Additionally, this program payment called “on-ramp” from October 1, 2023, to September 30, 2024 is a setup that lets payments continue while easing the impact of interest, as interest won’t pile up after 12 months. It’s important to note that during this time, late, missed, or partial payments won’t trigger student loan challenge default, credit bureau notices, or debt collection efforts. The aim is to give borrowers the chance to adjust their finances as payments and interest pick up again.