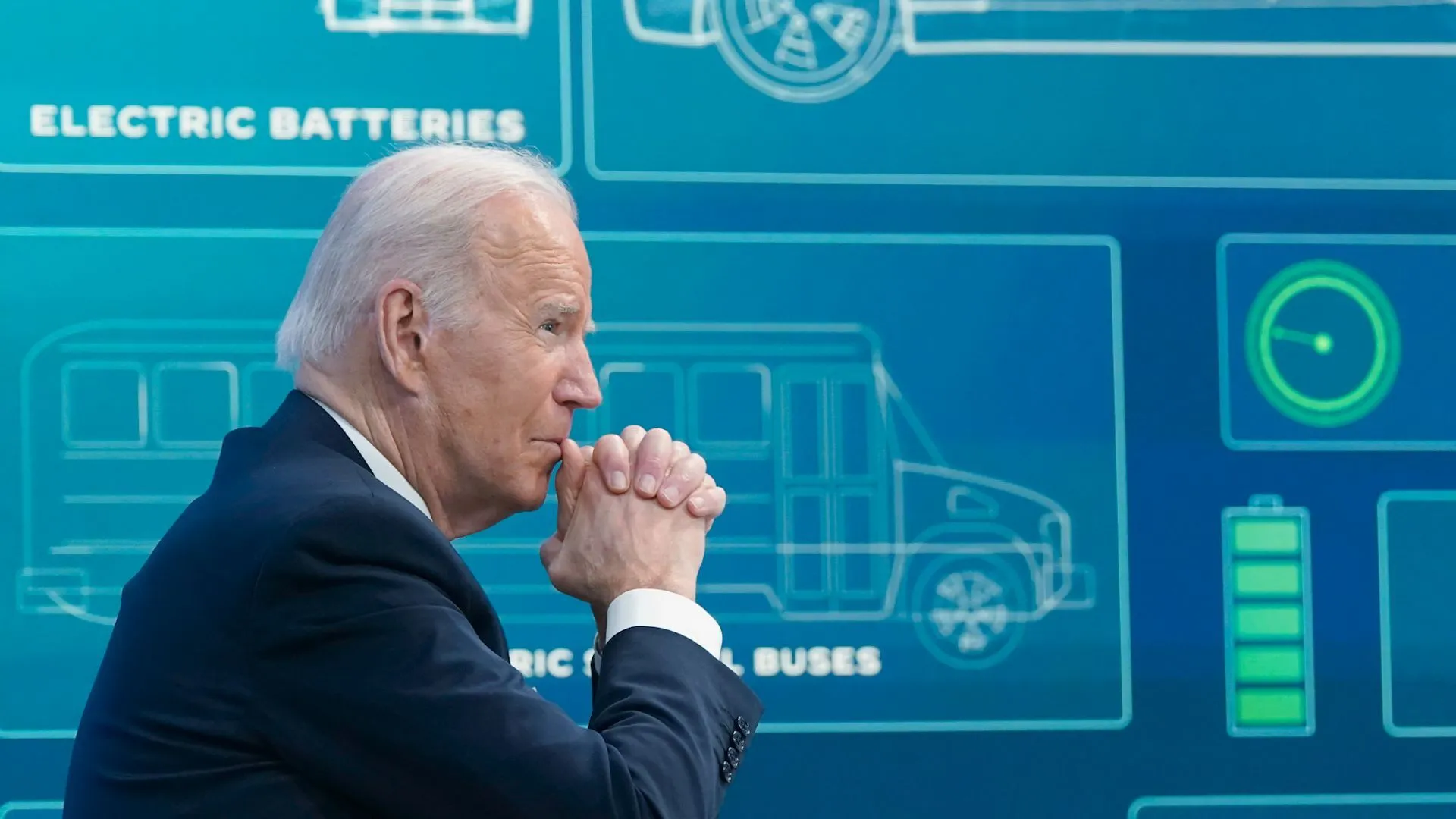

Biden Administration Grants 2-Year Exemption for EV Tax Credits, Raising Concerns and Support

Biden Administration Grants Two-Year Exemption for EV Tax Credits, Stirring Debate Flexibility for Automakers: Biden Administration’s EV Tax Credit Exemption Sparks Controversy In a move aimed at providing flexibility for automakers the Biden administration has granted a two-year exemption to certain provisions of the 2022 Inflation Reduction Act regarding electric vehicle (EV) tax credits, according … Read more