Struggling to Pay Back Student Loans? Here’s How Income-Driven Repayment Plans Can Help

Understand the Rules: Income-Driven Repayment Plans for Federal Student Loans Explained

According to money-digest, Many Americans who borrowed money to go to college are struggling to pay back their loans. A new plan could help them. The government is working on a way to forgive some of this debt using a law from 1965. But before people can use this plan, they need to know what it means.

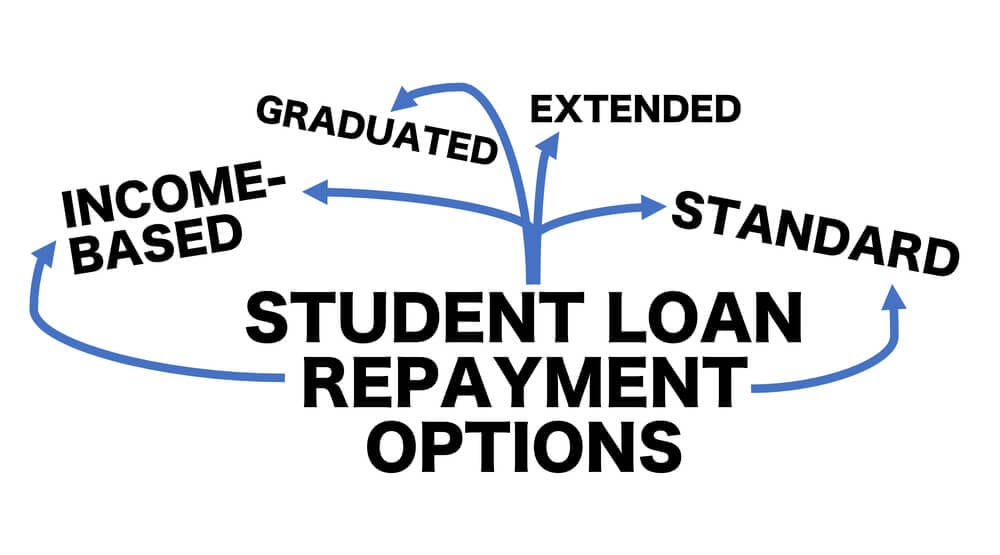

The government has four plans that can help Americans pay back their loans in a more affordable way. Each plan has its own rules. Some plans are only for people who borrowed money recently, while others are for people who have been paying back their loans for a while. These plans can make monthly payments smaller, but people might still have to pay taxes on the debt that’s forgiven. It’s important to keep track of income and family size so that payments don’t get too high.

READ ALSO: Schumer Prepares Vote on Bill to Expand Child Tax Credit in New York

Student Loan Relief: Which Income-Driven Repayment Plan is Right for You?

Not everyone might be able to use these plans, and it’s important to think carefully about which one is best. Some plans have different rules about interest rates and how long it takes to pay off the loan. One plan, called SAVE, is currently stuck in court because some states don’t think it’s fair. People who want to use these plans need to be aware of these rules and potential problems so they can make good decisions about their student loans.

READ ALSO: Medical Debt Relief of Up to $4 Billion Possible for 2 Million North Carolinians