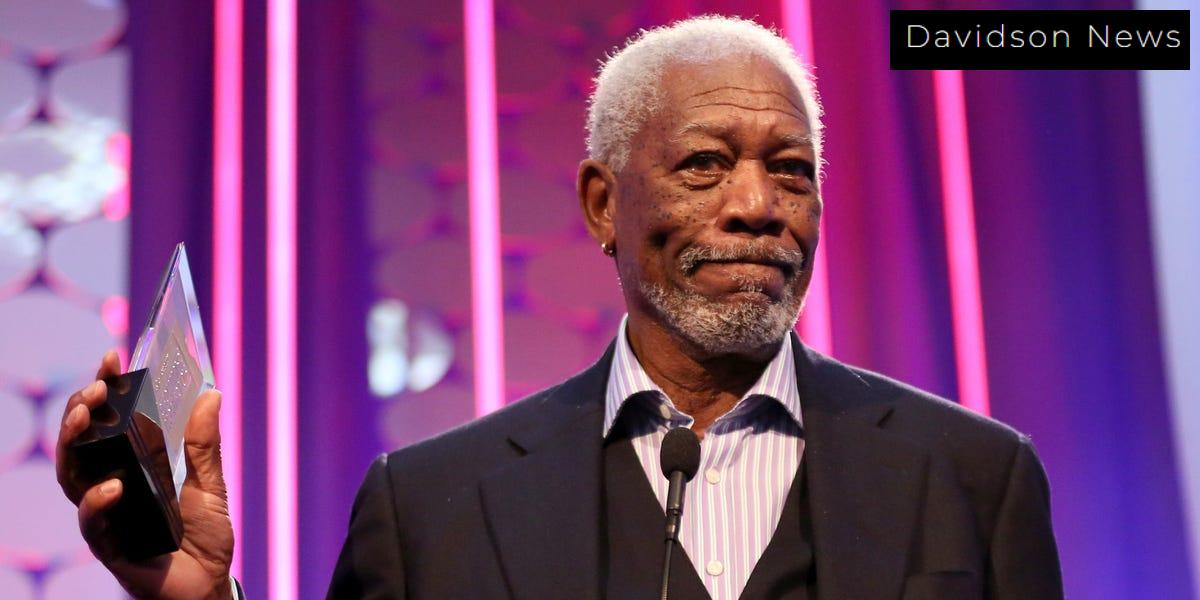

Elon Musk recently sparked interest in Tesla’s stock by sharing an old interview where actor Morgan Freeman mentioned he owned shares of the electric vehicle company back in 2016. Since then, the price of Tesla stock has skyrocketed, and this has led many to wonder about the wisdom of investing in Tesla’s future. This story not only revisits Freeman’s past investment decision, which would have turned a small amount into a fortune, but also sheds light on the current state of Tesla stock and what might lie ahead for investors.

From $10,000 to $307,000

Remember when Freeman mentioned he owned Tesla stock? If you had invested $10,000 in Tesla back in 2016, that amount would now be worth approximately $307,000. This is a spectacular return of nearly 3,000%, showcasing the incredible rise of Tesla in the stock market. In just a few years, Tesla’s market value leaped from $30 billion to an astounding $1.3 trillion. These numbers illustrate why many investors keep a close eye on Tesla, hoping to catch the next big wave.

What Does the Future Hold?

Even though Tesla stock has seen immense growth, the future is looking a bit cloudy. The company is set to report its fourth-quarter earnings soon, and analysts are interested to see how the numbers will look. They are predicting revenue to grow this quarter to around $27.27 billion, which is higher than last year’s $25.17 billion. Still, there’s talk that overall vehicle deliveries might not reach last year’s totals, leading to mixed feelings among investors.

Challenges on the Road Ahead

- Profit margins are declining, which means the company is making less money on each sale.

- Tesla has already had its first year-over-year drop in vehicle deliveries, causing some to worry about its stability.

- Even with a stellar reputation, Tesla’s growth ambitions in solar energy, battery technology, and artificial intelligence raise questions due to their high costs and competitive market.

Analysts Weigh In

Investors have different opinions about whether now is a good time to buy Tesla stock. While some analysts suggest it is a wise investment, others recommend caution. One major concern is that Tesla stock is quite pricey, currently with a price-to-earnings (P/E) ratio of 111, which is significantly higher than most companies in the S&P 500, who average much lower ratios.

The Big Picture

Amid the ups and downs, Musk’s vision and ambition remain unchanged, with Tesla continuously seeking new frontiers. These include ambitions in solar energy and self-driving technology, which could improve its market share and broaden its revenue base. However, investors are encouraged to closely watch for upcoming earnings reports, as they could set the course for Tesla and its stock in the near future.

Investing Insights

As the market buzzes with speculation, Freeman’s past decision to invest in Tesla raises an interesting question for all of us: Should we follow his lead? Although there’s potential for significant profits, it’s wise to consider the risks involved in investing. Always remember that investing isn’t just about numbers; it also requires careful thought and an eye toward future developments. Tech stocks can come with volatility, but they also offer exciting opportunities.

| Year | Investment ($) | Value Now ($) |

|---|---|---|

| 2016 | 10,000 | 307,000 |

| 2023 | Current | Varies |