Outgoing Pinal County Sheriff Mark Lamb signed a state-mandated legal disclosure — under penalty of perjury — that misrepresented his financial history when launching a law enforcement nonprofit in 2018. The public charity also has failed to file several required annual reports with the Arizona Corporation Commission.

An official with the commission, responding to Arizona Luminaria’s questions about the American Sheriff Foundation’s non-compliance, says their system didn’t catch the past three years of missing reports and now will dissolve Lamb’s foundation. However, the IRS revoked the nonprofit’s tax-exempt status in 2021.

Arizona’s annual reports call for nonprofits to include the principal officers’ names, organization’s addresses and confirm the name, type and character of the business. They are a single-page long and filled out online.

In 2018, when Lamb established the American Sheriff Foundation, Inc., the organization filed articles of incorporation for a nonprofit with the state. The public legal filings show a “certificate of disclosure” form, which includes questions about past felonies, frauds, thefts, violations of antitrust laws and financial history.

A box is checked “no” to the question of whether Lamb or his fellow incorporator for the nonprofit had ever filed for a bankruptcy tied to any separate corporation. But, as he has written about publicly in his self-published book, Lamb filed bankruptcy in Utah in 2003 when he and his wife were owners of a company called Paintball Junkeez.

Lamb signed the Arizona disclosure form in February 2018, stating he is the incorporator “submitting this Certificate.” Above his signature it says: “By typing or entering my name and checking the box marked “I accept” below, I acknowledge under penalty of perjury that this document together with any attachments is submitted in compliance with Arizona law.”

Lamb told Arizona Luminaria not disclosing his past bankruptcy as legally required was an honest oversight and not his fault.

“I don’t know who did those, that’s the lawyers,” Lamb said.

Lamb could have checked the box with a “yes” to the question about past bankruptcies, which would only have required the nonprofit filling out an additional form called a Certificate of Disclosure Bankruptcy Attachment.

“I’m not trying to hide anything,” he said. “Maybe I didn’t look at it closely enough when the lawyers put it together and I signed it. I don’t know. I can’t tell you. What I can tell you is that there’s no malicious intent.”

Arizona Luminaria reached out to an attorney who worked with the nonprofit’s filings in 2018. They did not immediately reply.

Arizona Law requires any founder or person incorporating a nonprofit to disclose whether or not they have previously filed for bankruptcy. Nicole Garcia, a spokesperson for the Arizona Corporation Commission, told Arizona Luminaria if someone had inaccurately represented information about a prior bankruptcy, the commission’s enforcement powers include terminating the nonprofit organization.

Committing perjury is also a Class 4 felony in Arizona. The commission’s duties include certifying nonprofits.

“If the Commission learned that a corporation failed to comply with the bankruptcy question, which is part of the certificate of disclosure, the Commission may commence the process for administrative dissolution,” Garcia said. “There may be judicial intervention if the attorney general determines that grounds for judicial dissolution are established.”

A spokesperson for the Arizona Attorney General’s office declined to comment on who is responsible for prosecuting a violation of perjury on required legal filings establishing a nonprofit.

Lamb shifted blame for the missing forms and incorrect information.

“You can’t trust people to do things, you got to do them yourself. If you don’t, that’s what happens,” Lamb said, stressing that the incorrectly marked box was a mistake. Lamb also said that the organization hasn’t collected money or donations since 2022.

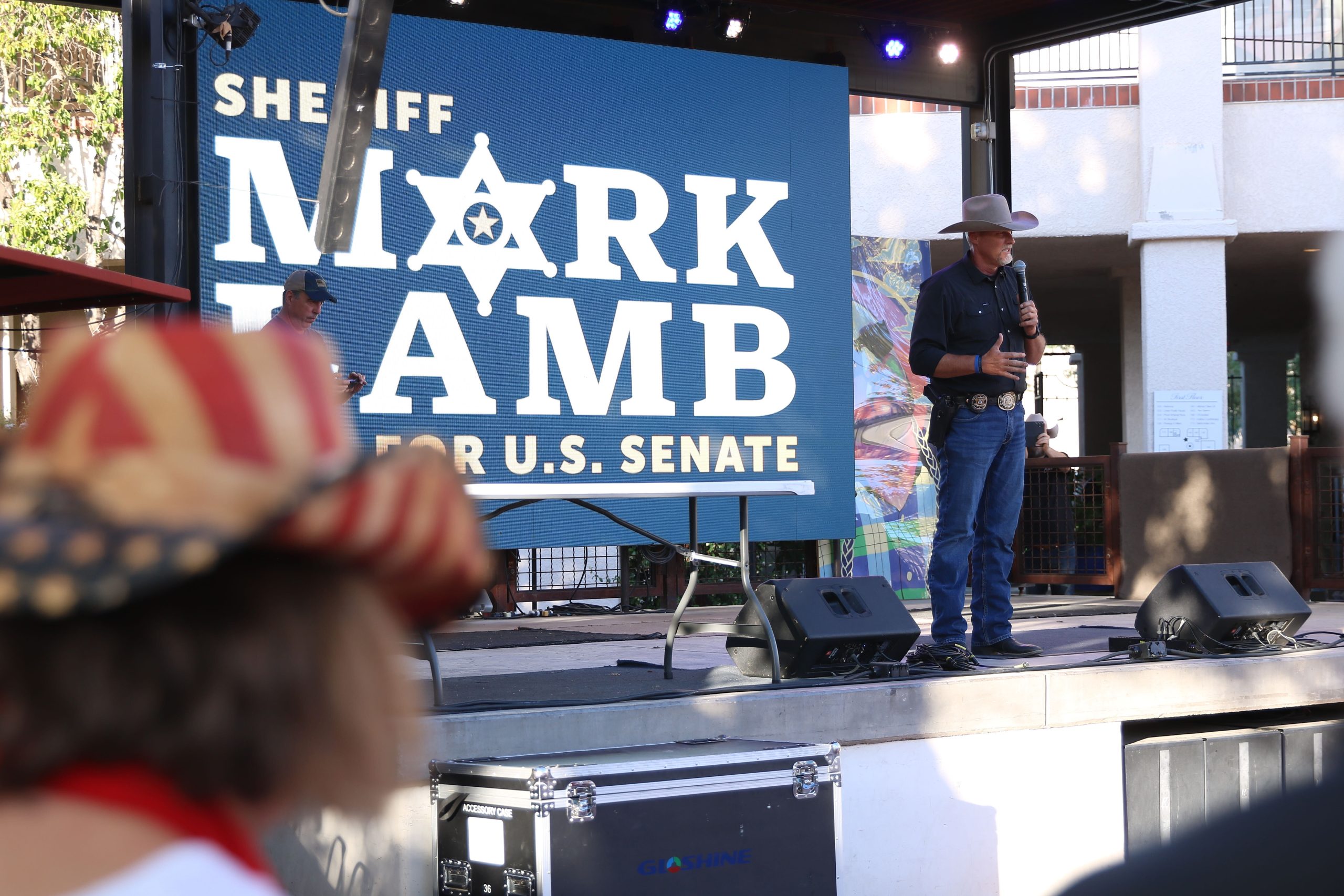

Lamb’s term as sheriff ends in January. He ran for U.S. Senate this year and lost in the Republican primary to Kari Lake, who lost to Democrat Ruben Gallego in the general election.

Lamb has long supported President-Elect Donald Trump, so much so that many have speculated he might be tapped for a leadership position in the new administration. Lamb told Arizona Luminaria in December that he is not being considered for the top post at the U.S. Marshals Service nor the Drug Enforcement Agency.

“I threw my name in the hat,” Lamb said of leading one of those federal agencies.

American Sheriff Foundation’s IRS status

In May 2021, the Internal Revenue Service revoked the tax exempt status from the American Sheriff Foundation for not filing mandatory tax reports — known as a Form 990.

“Organizations whose federal tax exempt status was automatically revoked for not filing a Form 990-series return or notice for three consecutive years,” was the reason cited on the IRS website, as of Dec. 20, 2024, for placing Lamb’s nonprofit on the auto-revocation list.

Qualifying as a federally recognized nonprofit — exempt from income taxes — makes it so “donors can deduct contributions” they give to the organization, stated an IRS official in a 2018 letter to the American Sheriff Foundation approving its nonprofit status as a 501(c)(3). The organization also qualifies “to receive tax deductible bequests, devises, transfers or gifts.”

The letter specified, “You’re required to file Form 990-PF … whether or not you have income or activity during the year.”

Lamb’s nonprofit shows no 990 tax filings disclosing American Sheriff Foundation’s spending, according to records current as of December 2024 on the IRS website.

Arizona Luminaria asked Lamb if he was aware that the IRS revoked his foundation’s nonprofit status in 2021. He did not immediately respond.

State and federal government organizations, as well as watchdog groups, monitor tax-exempt charities and nonprofits to ensure they comply with all regulations and the money they raise is legally and properly allocated.

Laurie Styron is the executive director of the nonprofit watchdog organization CharityWatch, which helps the public assess the reliability — via ratings — of nonprofit organizations.

“An officer of an organization that is raising money from the public is being entrusted to use those funds responsibly and in good faith,” Styron said. “The reason many states ask for past bankruptcies to be disclosed is so the public can better understand if this is someone who is not only trustworthy but who is also capable of managing money well.”

A short history of the American Sheriff Foundation

The American Sheriff Foundation was established as a nonprofit meant to “bridge the gap between communities and law enforcement,” according to the organization’s Facebook page. The page hasn’t been updated since February 2022.

The organization’s website, americansheriff.org, now sends users directly to sherifflamb.com, which sells Mark Lamb bobbleheads, his and his wife’s books, and spotlights some of Lamb’s media appearances.

No one from the American Sheriff Foundation has filed an annual report with the Arizona Corporation Commission since 2021.

On the Arizona Corporation Commission’s website, as of Dec. 20, American Sheriff Foundation was three years overdue on its annual reports, having failed to file in 2022, 2023 and 2024.

When asked about the failures to file and the “active” and “in good standing” status listed on the commission’s website, Garcia, the state corporation commission spokesperson, said in an email to Arizona Luminaria they “can confirm that American Sheriff Foundation, Inc. should NOT be active and in good standing.”

“Because they are delinquent with filing their annual reports, Corporations Division staff will start the administrative dissolution process,” Garcia said.

The same month in 2018 that Lamb incorporated the American Sheriff Foundation, he also established American Sheriff LLC. In the founding documents for the LLC, unlike the state-regulations for nonprofits, he did not have to disclose whether or not he’d ever filed bankruptcy.

From small-business owner to sheriff

Lamb wrote about his Utah bankruptcy in his self-published 2020 book, “American Sheriff: Traditional Values in a Modern World.” He and his family were living in Payson, Utah, where he owned Paintball Junkeez, according to the book. He said online shopping and the opening of a nearby Walmart — “the kiss of death for my little business” — led to declining sales and then the shuttering of the business.

“I was coming to terms with the fact that the only way out financially was to declare bankruptcy,” Lamb wrote.

In 2020, the Arizona Republic published an article about unaccounted money raised by American Sheriff Foundation. According to the article, the use or whereabouts of $18,000 were not specified on tax filings for Lamb’s nonprofit. In its first year of operation, the nonprofit raised at least $50,000 dollars.

Arizona Luminaria reported in 2023 on the Pinal County Sheriff’s Office — led by Lamb — misusing money legally required for “inmate welfare” at the county jail. At least $217,000 from a jail commissary fund that Arizona lawmakers mandated “for the benefit and welfare of inmates” were instead used by Lamb’s department to buy a cache of weapons, ammunition and ballistic vests.

Lamb explained the spending to the Pinal County Board of Supervisors, saying that the guns and ammo helped his officers more safely do their job. He received unanimous support from the board with one supervisor saying, “We leave your business to your business. You know it better than I do.”

Lamb told Arizona Luminaria that his role as a law enforcement officer is all-consuming and he wishes he had been more diligent with the nonprofit corporation tax and legal filings.

“You just don’t understand how hard these jobs are to do,” Lamb said of his role as the sheriff. He reiterated his concerns about the American Sheriff Foundation’s financial history disclosure: “I guess I should have looked at it a little closer.”

He said that he was considering going back to amend the articles of incorporation for the nonprofit.

“Now that you’ve brought it to my attention I would make a little amendment and it’s not a problem,” he said. He also told Arizona Luminaria he may remake the foundation into a corporate entity instead of a nonprofit.

With his days ending soon as Pinal County sheriff, Lamb said he’s considering a career in the private business sector.