Student Loan Debt Crisis for Baby Boomers: Top 5 Cities with $41,877 Average Balance

How Student Loan Debt Impacts Baby Boomers: Key Cities and Financial Struggles in 2024

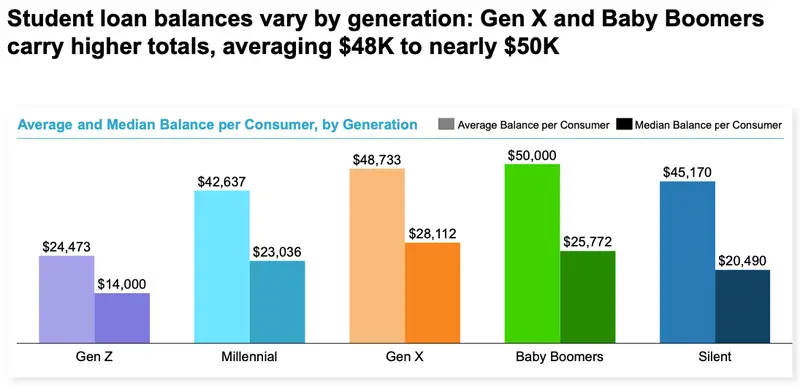

Student loan debt isn’t just a challenge for younger generations; it’s also a significant burden for many baby boomers, according to the published article of GOBankingRates. With total student loan debt in the U.S. reaching a staggering $1.753 trillion older Americans are feeling the squeeze as well. Baby boomers aged 60 to 78 are carrying an average student loan balance of $41,877, according to Experian. This mounting debt is not just a statistic but a reality impacting their financial stability and retirement plans. In cities across the nation the student loan crisis hits particularly hard. For instance in Atlanta, Georgia and San Francisco, California many boomers are grappling with substantial student loans. These cities known for their high cost of living contribute to the growing financial strain on older individuals. Fred Amrein CEO of PayForEd explains that the traditional student loan limits often fall short necessitating additional funding through savings or cash flow—a challenge many families struggle to meet.

As the cost of college continues to rise, the pressure on older generations to manage their student loan debt remains intense. With baby boomers facing these financial hurdles, it’s crucial for policymakers to address this issue and provide support for those struggling to repay their loans. For those affected understanding their options and seeking financial advice can help navigate this challenging landscape.

READ ALSO: Oakland County Launches Michigan’s First Student Debt Relief Initiative

Baby Boomers’ $1.753 Trillion Student Loan Burden: Cities Facing the Most Severe Debt Issues

Furthermore, the burden of student loan debt on baby boomers highlights a growing financial disparity that extends beyond the younger generations. In cities like Miami, Florida and Denver, Colorado the struggle is particularly pronounced. These locations not only have high living costs but also contribute to the increasing financial stress on older adults who are still paying off college loans. The escalating student debt crisis for boomers underscores the need for comprehensive solutions to address the affordability of higher education and the long-term impact on individuals’ financial well-being. For many baby boomers the impact of student loan debt extends into their retirement plans affecting their ability to save and invest for the future. The debt strain often means fewer resources available for retirement savings and investments creating a challenging scenario for those who hoped to enjoy their later years without financial worry. As this issue grows it’s important for financial advisors and policymakers to develop strategies that offer relief and support for those grappling with these burdens.

READ ALSO: 3 Significant Social Security Changes That Will Shock Many Americans in 2025