Tax Season 2024: 10 Income Sources the IRS Won’t Tax for Maximum Savings

2024 Tax Season Guide: Top 10 Types of Tax-Free Income to Know

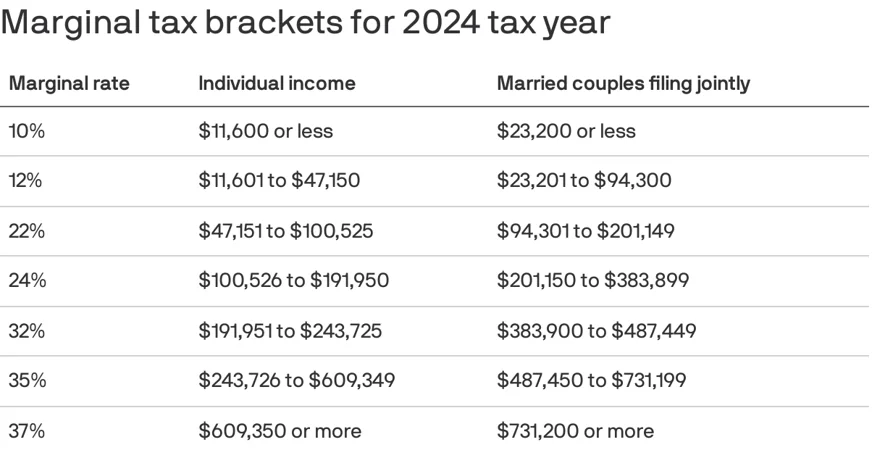

As you prepare for tax season in 2024 it’s important to know which types of income won’t be taxed potentially saving you money, according to the published article of FINANCEBUZZ. The IRS has designated several sources of income as tax-free this year. These include child support payments, certain alimony payments, cash back rewards from credit cards and inheritances. Additionally, life insurance payouts Olympic and Paralympic medals and prize money, qualified adoption expenses and health care benefits are also exempt from taxation. Retail cash rebates scholarships used for qualifying education costs and gifts up to $18,000 are other items that won’t affect your tax bill. Understanding these tax-free sources can help you maximize your savings and reduce your tax burden. For example, while cash back rewards from credit cards and retail rebates might seem like small savings they add up over time without the worry of additional taxes.

Similarly, life insurance payouts and inheritances can provide financial relief during difficult times without the stress of unexpected tax bills. If you’re adopting a child or participating in health care programs knowing these benefits are tax-free can significantly impact your financial planning. It’s always wise to confirm with a tax professional or accountant to ensure you’re fully aware of any changes to tax laws and to accurately prepare your tax return. Tax software can also help by incorporating the latest regulations but double-checking with an expert can provide added peace of mind. By staying informed about what income is tax-free you can make better financial decisions and potentially enjoy a larger return next year.

READ ALSO: Higher Tax Rates and Changes Await as Trump Tax Cuts End

Save Big This Tax Season: 10 IRS-Approved Tax-Free Income Sources for 2024

Moreover, knowing what income the IRS doesn’t tax in 2024 can significantly impact your financial strategy and planning. For instance while many people are aware that child support and certain alimony payments are not taxed understanding that these benefits and other sources of non-taxable income can help you make more informed decisions throughout the year. This knowledge allows you to budget more effectively, save more and avoid unexpected tax liabilities. Additionally, if you’re receiving cash back from credit cards or rebates from retail purchases you can use these funds freely without worrying about additional taxes. Similarly, if you’re a recipient of a life insurance payout or an Olympic medalist you can focus on managing and enjoying these benefits without the stress of tax implications.

READ ALSO: A US appeals court has blocked the Biden administration’s attempt to cancel student loans