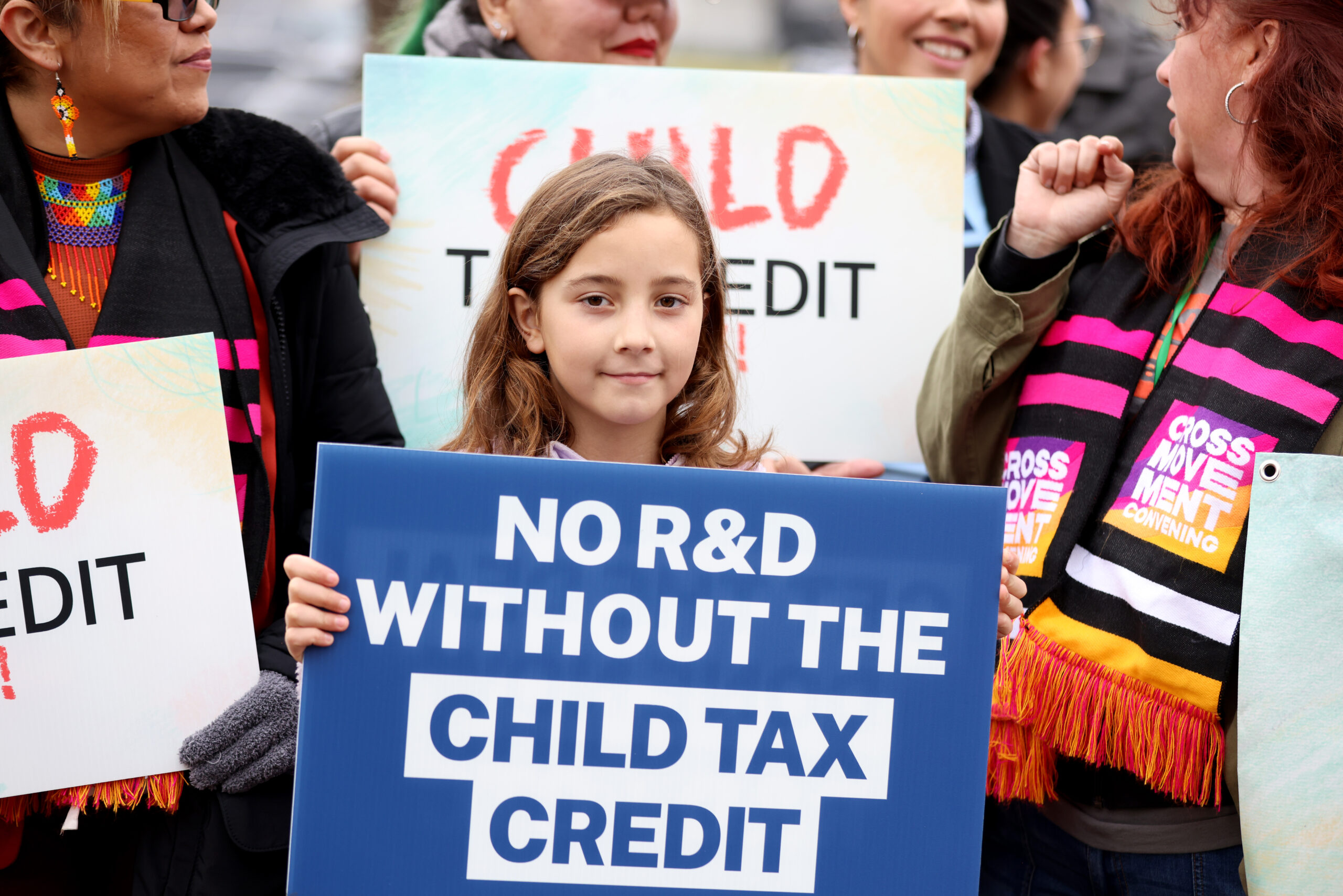

Minnesota’s Child Tax Credit Program: A Lifeline for Low-Income Families

Boosting Family Incomes: How the Child Tax Credit is Making a Difference

According to willing, Minnesota has a special program to help low- and middle-income families with young children. This program gives a tax credit of $1,750 for each child. The credit goes away as the family’s income increases.

So far, this program has helped 210,000 families in Minnesota. These families earn an average of $2,500 or $1,250 per child. The program is meant to help families who need it most and reduce child poverty.

READ ALSO: California’s $6000 Stimulus Program: Eligibility Criteria and Impact on Residents

Early Access to Child Tax Credits: A Game-Changer for Families

Next year, families will have the option to receive half of their credit in advance payments. This means they’ll get some money before they have to file their taxes. The exact schedule for these payments is still being worked out, but it will help families pay their bills on time. This is similar to a program that was started during the pandemic, where families received monthly payments for each child.

READ ALSO: California’s $6000 Stimulus Program: Eligibility Criteria and Impact on Residents