When Will You Get Your Tax Refund?

Why Your Tax Refund Might Be Delayed

According to Fool, When you wait for your tax refund, it’s normal to feel a little impatient. But did you know that the IRS has to pay interest if they take too long to give you your refund? This is true if they don’t make a mistake on your return and still take longer than 45 days to give you your refund.

Some things can cause delays in getting your refund. For example, if there’s an error on your return, or if the bank account information is wrong. If you filed your return on paper, it might take longer to process. But if the IRS doesn’t make a mistake, they have to give you your refund within 45 days.

READ ALSO: Burger King Launches $5 Value Meal Promotion Amid Rising Fast-Food Prices

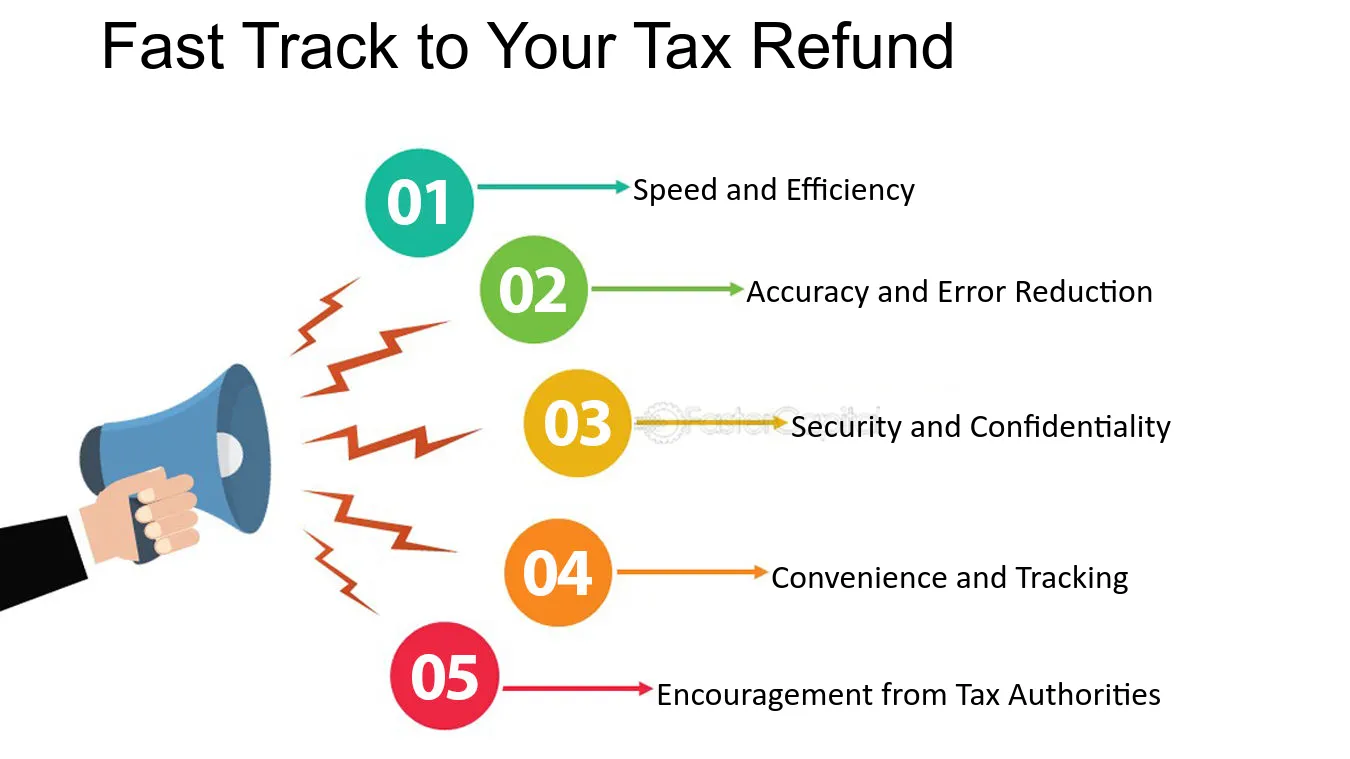

Track Your Tax Refund: A Step-by-Step Guide

So, what can you do if you’re waiting for your tax refund? You can use the IRS‘s “Where’s My Refund” tool to check on your refund. This tool will give you updates on your refund and tell you when it will be ready. You’ll need to know your Social Security number, your tax filing status, and how much your refund is.

READ ALSO: California’s Delay in Tiny Homes for Homeless Sparks Controversy