Biden Administration Grants Two-Year Exemption for EV Tax Credits, Stirring Debate

Flexibility for Automakers: Biden Administration’s EV Tax Credit Exemption Sparks Controversy

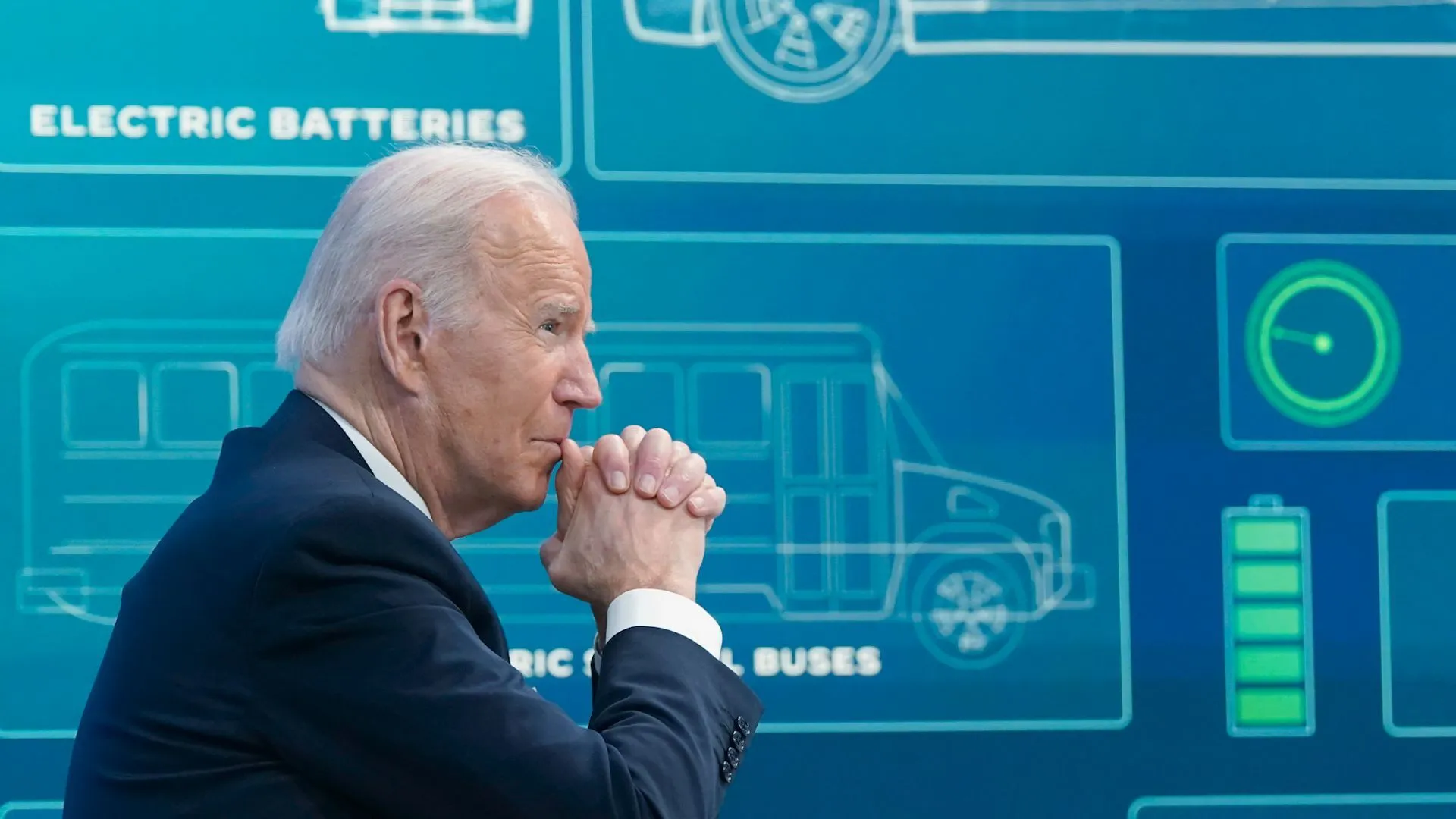

In a move aimed at providing flexibility for automakers the Biden administration has granted a two-year exemption to certain provisions of the 2022 Inflation Reduction Act regarding electric vehicle (EV) tax credits, according to the published article of THE HILL. The exemption relaxes restrictions on vehicles’ eligibility if their battery minerals originate from China, Russia, Iran or North Korea, particularly for minerals of low value that are challenging to trace. Notably, the exemption has been extended to include graphite a mineral frequently sourced from China. This decision, while welcomed by some, including the Alliance for Automotive Innovation has drawn criticism from key figures like Sen. Joe Manchin who expressed concerns even before the exemption was expanded to include graphite.

The final guidance from the Treasury Department solidifies the Biden administration’s rules on eligibility for EV tax credits which have expanded under the 2022 law. While this move aims to bolster EV adoption and support investment and job creation, it also raises questions about potential dependencies on adversarial nations for critical minerals. Organizations like Safe’s Center for Critical Minerals Strategy emphasize the importance of a clear exit strategy to prevent such dependencies from undermining the competitiveness of U.S. and allied critical minerals projects. The administration’s broader efforts to promote EV adoption align with its climate change mitigation goals, as it imposes restrictions on automakers expected to boost the share of electric car sales significantly in the coming years.

READ ALSO: Taxing Questions: Sports Team Owners Paying Less than Players Spark IRS Probe

Biden Administration’s Nuanced Approach: Balancing EV Tax Credit Flexibility with Geopolitical Concerns

Furthermore, the Biden administration’s decision to grant flexibility to automakers in EV tax credit rules reflects a nuanced approach to balancing economic incentives with environmental imperatives. While the exemption aims to alleviate constraints on vehicle eligibility and incentivize EV adoption it also raises concerns about potential geopolitical implications and long-term strategic dependencies on critical minerals. Organizations such as Safe’s Center for Critical Minerals Strategy highlight the need for a clear exit strategy to safeguard U.S. and allied interests in the global supply chain. In addition to addressing concerns around mineral sourcing the administration’s broader efforts to streamline EV tax credit processes and promote upfront redemption signal a proactive stance in advancing sustainable transportation solutions. By simplifying access to incentives and fostering innovation within the automotive industry, policymakers aim to accelerate the transition towards a greener transportation sector while bolstering domestic manufacturing and job creation.

READ ALSO: IRS Turbocharges Tax Enforcement Targeting the Wealthy, Expanding Workforce